“Whatever it takes.” With these words, Mario Draghi, former president of the European Central Bank (ECB), inaugurated the decade marked by the lowest interest rates in the history of the Eurozone. The situation was truly complex that July 26th, 2012 in London, where Draghi spoke these words that would act as collateral without risk for the euro. SMEs across Europe saw their survival in jeopardy, unemployment rates soared to all-time highs, and there was talk of a situation that transcended the economic scene: the threat of having a “lost generation” in the southern countries of the Old Continent.

The financial crisis, derived from the bursting of the housing bubble and the subprimes, hit the bank credit lines directed to cover the productive economy. Banks turned off the tap on financing for companies and families, and Europe seemed to have entered a vicious circle from which it could not escape.

Banks needed money, a lot, to be able to clean up their battered accounts and transmit it to the economy in the form of loans and credit. Faced with this situation, the ECB made the determination to execute quantitative easing through which it would flood the financial system with liquidity and revive companies. At least, this was the theory.

Quantitative Easing (QE) consists, briefly and concisely, of a series of measures that allow more money to be on the market. This is mainly achieved through the purchase of public and corporate debt by the ECB, accompanied by reductions in the reference interest rate, which stimulates indebtedness. Theory tells us that these tools sometimes serve to reactivate the economy. They are known as conjunctural measures.

Since Draghi made that speech, the reference interest rate has dropped from 0.75 percent in 2012 to 0 percent in 2016. In 2015, a debt purchase program began, which meant the acquisition of 260,000 million euros in Spanish bonds and obligations until December 2018.

QE was implemented with maximum intensity, but did it serve to fulfill its mission: to make credit flow to SMEs and families?

Graph 1. Total funding of non-financial sectors resident in Spain (data in thousands of euros).

A priori, taking a look at this graph, we could think that, although funding continued to be constrained for the first four years, a positive trend change began in 2016. And indeed, that is the case, and so it is sold in the mainstream media. Credit is once again abundant and flowing into the economy. Or not?

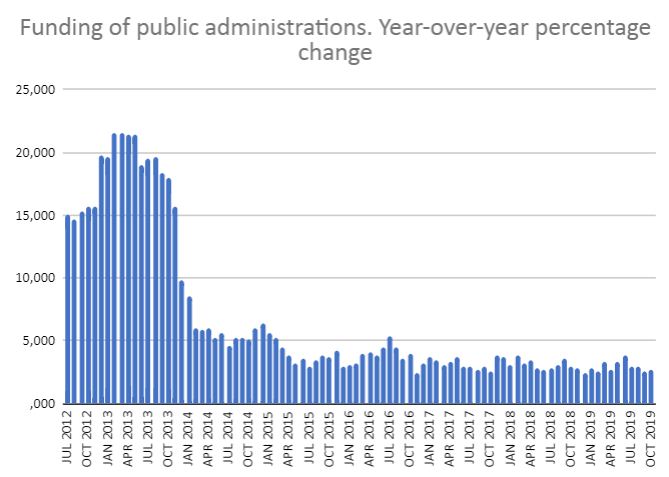

Graph 2. Funding of public administrations. Year-over-year percentage change

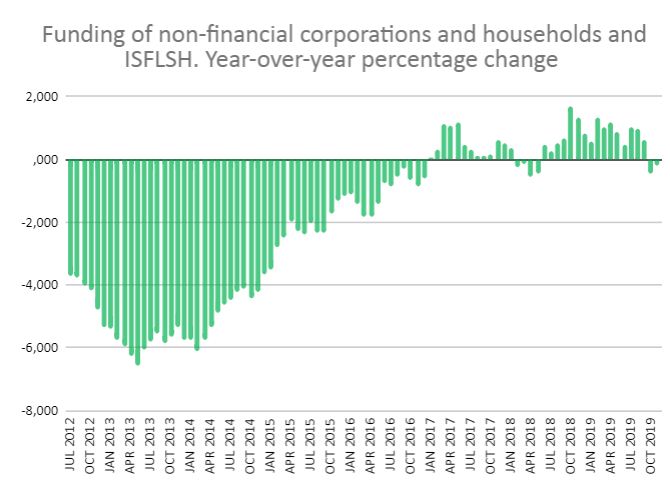

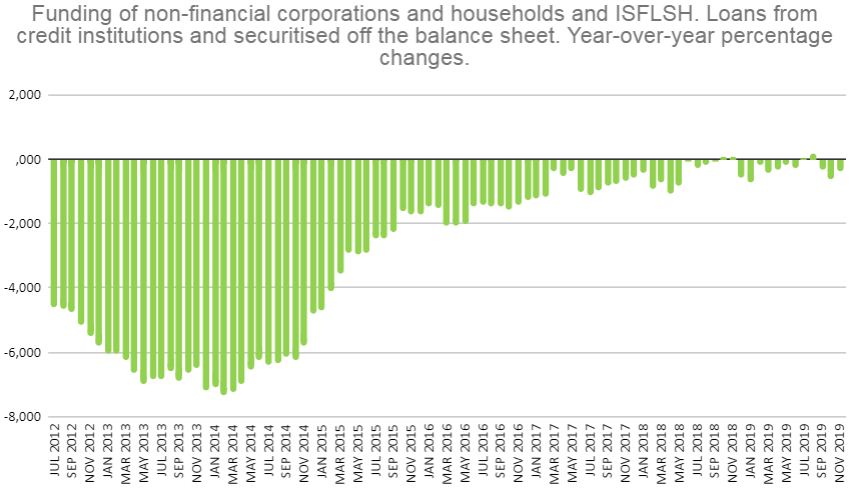

Graph 3. Funding of non-financial corporations and households and ISFLSH. Year-over-year percentage change

As we can see, the flood of liquidity in the market brought about by the ECB mainly affected credit destined to public administrations, which did not see their financing decrease for a single month in the period analysed and were able to take a substantial advantage of this monetary injection.

On the contrary, the one directed to companies, families and non-profit institutions at the service of households (ISFLSH) was strongly reduced until the beginning of 2017. The average increase since then until now has been estimated at 0.51 percent, while, from July 2012 to 2017, the contraction of credit to the productive sectors registered an average of -3.6 percent.

Based on the previous data, it seems clear that the ECB’s credit expansion (QE) has had a clear beneficiary in Spain: the public sector. The 0 percent interest rate that cancels the intertemporal preference for money has meant little progress to fund the productive economy, which clashes head-on with its theoretical objective.

The abundance of liquidity in the market should flow to an economy as ‘banked’ as the Spanish one via credit institutions.

While families and companies have been deleveraged since the outbreak of the crisis, the State has gone from registering a public debt on GDP from 86.30 percent in 2012 to 97.60 percent in 2018. Every Spanish owes 25,000 euros because of the public debt, stimulated by the ECB.

The abundance of liquidity in the market that, as we have seen, has as its main objective to reach companies, especially SMEs, should flow to an economy as ‘banked’ as the Spanish one via credit institutions.

Graph 4. Funding of non-financial corporations and households and ISFLSH. Loans from credit institutions and securitised off the balance sheet. Year-over-year percentage change

However, we see how, from 2012 to this day, the funding of credit institutions to families and companies has decreased from 89 to 85 months. The weak increase since early 2017 is mainly due to an increase of activity in the capital and debt markets, and to external funding.

SMEs and self-employed amount to 99.8 percent of the business fabric of our country. The vast majority of them do not have access to financial markets due to their size. These companies, whose difficulty to fund themselves is greater than that of large companies, were the target of the ECB’s «free money» policy. But the evident inability to make the money generated flow into the productive fabric, together with the notorious ability to attract these funds by the public sector, demonstrate the failures and vices of interventionism in the money market.