Main conclusions

(i) The tax reform of Navarra increases the personal income tax to all gross income of more than 19,500 euros.

(ii) Taxpayers with a gross income of 62,740 euros will be those who will suffer the greatest percentage increase, since they will pay 7% more taxes in 2016, the equivalent of 1,250 euros.

(iii) Regardless of the level of income, Navarra taxpayers will pay more for personal income tax than residents of the Basque Country, La Rioja or Madrid.

(iv) The non-tax reform for lower incomes will mean that a mileurist will have to pay in 2016 up to 436 euros more for the Income Tax in Navarra than in Madrid.

(v) Having children in Navarra implies a tax surcharge against Madrid that ranges from 4.8% to 126%.

(vi) With an income below 16,000 euros gross and two children, up to 500 euros more in income tax is paid in Navarre than in Madrid.

(vii) The modification of the minimum exempt amount from the Property Tax can be translated into a fall in GDP and a salary contraction of up to one percentage point and a reduction in the capital stock of up to 3 percentage points.

Analysis

The regional regime has so far allowed Navarra’s taxpayers to benefit from lower labour taxes than those of other autonomous communities. In addition, together with the productive structure, the tax framework has favoured the entire Navarra economy, which has resulted in a very low unemployment rate and a Gross Domestic Product level above both the European and Spanish average.

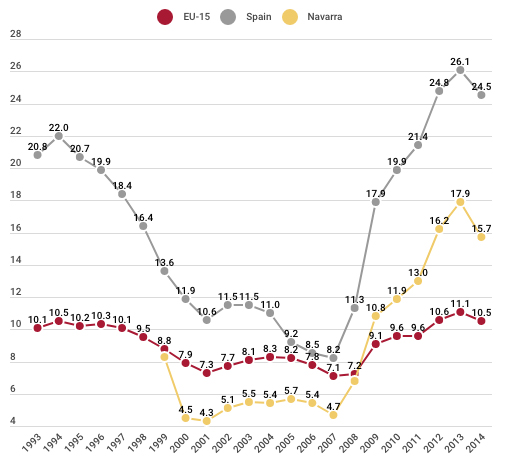

The report A tax framework for employment, infers that unemployment in Spain is not a consequence of the economic crisis, but that our country has always had unemployment above the EU average. This difference is due to structural problems of the labour market and the high taxation of labour. However, the unemployment rate in Navarra has always been between 30 and 40 percent lower than the Spanish average and is also below the European average. However, as of 2009, unemployment figures in Navarra skyrocket, staying above the EU average, despite the slight economic recovery.

To reduce unemployment and activate consumption, the report of the European Commission (Taxation Paper No 56., European Commission 2015) recommends reducing labour taxes. Apart from income tax, salaries in Navarra and Spain are also ‘taxed’ by social security contributions. However, it is the income tax that makes the difference, and not the contributions, which are the same nation-wide

Graph 1. Evolution of the unemployment rate: 1993-2014

Income tax in Navarra

As it is well known, Navarra has its own regional regime, which allows it to legislate on 100 percent of the Income Tax, and not only on 50 percent, as is the case of the autonomous communities of common regime. Until now, this financing model has been a competitive advantage for Navarra over other regions. And yet, this same model is the one that now prevents Navarrese taxpayers from benefiting from the tax reduction implemented by the central government. Therefore, it is important to know what the position of Navarra’s taxpayers will be compared to those of the other autonomous communities after the tax reform proposed by the Government of Navarra.

Tax rates

After the reform, the maximum rate in Navarra will rise to 52 percent, being the highest of all the autonomous communities, even above the 49 percent applied in the Basque Country. Moreover, the maximum tax rate for the average of the EU-28 countries is 39.4 percent, 12.6 points below the maximum that will be applied in 2016 in Navarra. This high tax rate not only affects taxpayers who already reside in Navarra, but it will represent a barrier to entry for highly qualified people. In addition, sooner or later it will also be a reason for tax emigration to autonomous communities with more favorable tax regimes. Navarra will go from being the autonomous community that attracted talent because of its tax system to be an exporter of the most qualified citizens and taxpayers. Do not forget that income in Navarra has always been higher than the Spanish average.

How will the tax reform affect the different income levels?

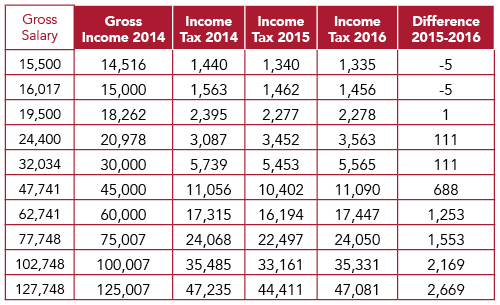

The tax reform has a null or almost null effect —a saving of 5 euros per year— on gross salaries lower than 19,500 euros. On the contrary, from that level all taxpayers will be affected by the tax increase. In 2016, all those with gross salaries of more than 19,500 euros will pay for personal income tax between 1 and 2,700 euros more than in 2015.

More specifically, for an average income of 24,400 euros, the tax reform will involve an increase of 50 euros in income tax. On the other hand, incomes of 47,700 euros will increase their tax effort by almost 700 euros. However, it is the taxpayers with a gross income of 62,740 euros who will suffer the greatest percentage increase, since they will pay 7 percent more taxes in 2016; the equivalent of 1,250 euros.

Table 1. Income Tax in Navarra: 2014-2016

As we can see, these numbers are far from those presented at a press conference by the Government of Navarra on the impact of the tax reform and the amounts payable by personal income tax in 2016 and in the two previous years.

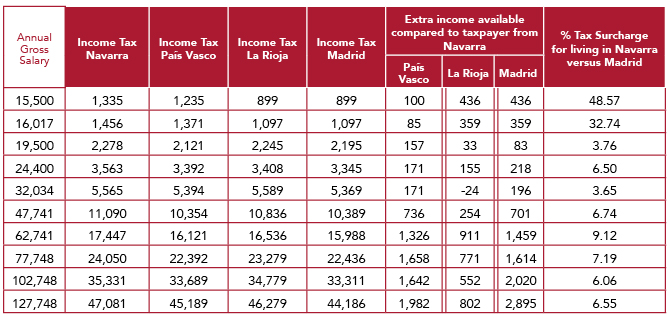

It is important to specify that the data presented in this section have been calculated for a single person, without children or other family charges, who are entitled to deduction for work, and we also apply the tax legislation in force in the corresponding years. Navarra versus La Rioja, the Basque Country and Madrid. Regardless of the level of income, Navarra’s taxpayers will pay more in income tax than residents of the Basque Country, La Rioja or Madrid.

Table 2. The Income Tax in Navarra, the Basque Country, La Rioja and Madrid in 2016

Although taxes will not be raised to Navarra’s taxpayers who charge less than 16,000 euros gross per year, they will be the most harmed compared to those of the other autonomous communities, since they pay up to 49 percent more for personal income tax than in Madrid or La Rioja.

The state reform of the personal income tax and the regional decreases have benefited the lowest incomes of the autonomous communities of common regime, which has resulted in an employee who makes 1,000 euros a month from Madrid or La Rioja —i.e. a gross annual salary of 15,500 euros— enjoying, in 2016, 436 euros more of disposable income than a Navarrese employee in the same circumstances.

At all levels, taxpayers in La Rioja, the Basque Country and Madrid have a higher disposable income thanks to a better tax treatment. With a gross income of 19,500, 47,741 or 77,747 euros, of the four autonomous communities analysed, taxpayers will have a greater disposable income in the Basque Country. On the other hand, taxpayers with income of 24,400, 32,034, or above 102,748 euros, will have a greater disposable income, of up to 2,895 euros —i.e. a gross salary of 127,748 euros—, if they make their tax declaration in Madrid. It is important to note that an average income of 24,400 euros will pay, in 2016, 218 euros more in income tax in Navarra compared to Madrid.

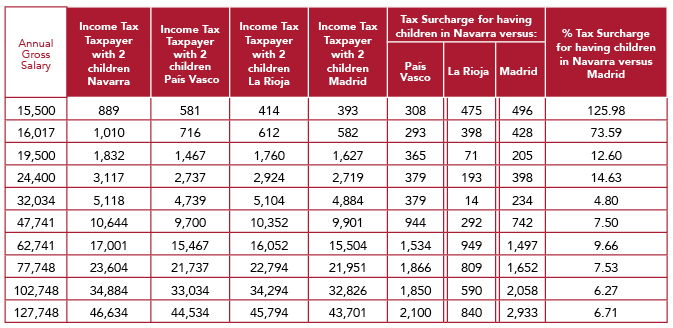

Where is it worth having children?

Having children in Madrid, La Rioja or the Basque Country brings a greater tax relief than in Navarra. With an gross income below 16,000 euros and two children, in Navarra there would be paid as income tax up to 500 euros extra (126 percent more) than in Madrid. In fact, regardless of the income segment, having children implies having a greater disposable income in any of the three autonomous communities analysed than in Navarra.

With a gross salary of 19,500, or between 32,034 and 77,748 euros and two dependent children, of the four autonomous communities studied, taxpayers will have a higher disposable income in the Basque Country: from 365 euros to 1,866. On the other hand, taxpayers with a gross salary of 24,400 euros and those who earn more than 102,748 will have a higher disposable income, up to 3,000 euros (400 in the case of an average salary), if they reside in Madrid.

Therefore, having children in Navarra implies a tax surcharge against Madrid that ranges from 4.8 percent to 126 percent. This is due in part to the fact that the state tax reform that took effect in January 2015 raised family and personal minimums, making it more bearable to have children, which has translated into greater benefits for lower incomes. In addition, some Autonomous Communities have also reformed their personal and family minimums, making the sum of the two (the state and regional section) benefit the taxpayers subject to the common regime.

Table 3. The taxation of families in Navarra, the Basque Country, La Rioja and Madrid in 2016

More tax increases

The tax reform not only foresees raising the income tax, but also other taxes, such as equity tax or the one that taxes hydrocarbons. It is striking, however, that a more progressive income tax is to be passed and that, at the same time, the expected collection through the hydrocarbon tax represents half of the income tax revenue.

As is well known, the hydrocarbons tax is a consumption tax and, therefore, is not progressive, which affects lower incomes in a larger proportion. This measure is still surprising, given that the autonomous communities around Navarra, such as La Rioja or the Basque Provinces, do not apply it. This will result in a customer leak to other neighbouring regions.

On the other hand, the minimum exempt amount set in the estate tax will be the lowest of all the autonomous communities. In addition, we must not forget that in La Rioja there is a tax bonus of the 50 percent and, in Madrid, 100 percent. This, coupled with the fact that the personal income tax has risen for higher incomes, makes it very likely to result in a taxpayer escape to these two autonomous communities.

According to a report of the Tax Foundation, the introduction of the estate tax with a minimum exempt of $1,300,000 would result in a GDP fall of 4.9 percent, a salary contraction of 4.2 percent and the stock decrease of capital of 13.3 percent. On the other hand, a minimum exempt of $260,000 would generate a decrease in gross domestic product and additional salary of 1 percent, while the capital stock would be reduced by 3 percent more. Although it is clear that the effect of the estate tax on the economy as a whole is negative, it is important to consider the result that a difference in the application of the minimum tax-free amount may create between Navarra and the rest of the country.

Conclusions

It can be said that the tax reform affects Navarrese in different ways:

(a) First, through the non-reduction of the income tax rates that were implemented in the central tax reform and also in some regional ones. This has resulted in the fact that, although there is no effective tax increase, lower incomes pay more in Navarra than in other autonomous communities.

(b) Secondly, due to the non-increase in personal and family minimums exempt amount, as is the case at the state level and in other autonomous communities. This way, families with children are severely harmed in Navarra.

(c) Finally, through the effective rise in tax rates. Given that personal and family reductions no longer reduce the liquidable base, this means that many incomes are now taxed at tax rates higher than those applied in 2015, regardless of whether deductions are applied later on.

The effects of the tax reform will soon appear, as the mobility of Navarra’s workers has increased and their preferred destinations are La Rioja, the Basque Country and Madrid. In addition, people with higher incomes are those with greater territorial mobility, hence it is plausible to expect that, sooner or later, these people choose more favourable tax regimes, and especially if they are in neighbouring communities. On the other hand, the reform will function as an entry barrier to attract highly qualified human capital.

On the other hand, the non-tax reform for lower incomes also harms this group, since they pay up to twice as much taxes as in neighbouring autonomous communities. Hence, people who are actively seeking for employment prefer to accept a job in another region, since with the same salary they will have higher disposable income.

It has also been shown that families with children have a significant tax surcharge compared to other autonomous communities. However, it is probably these families with children who have the least mobility, hence the greatest weight of the reform falls on them. On the other hand, the message behind this reform is key for young people who are considering starting a family: they will have higher incomes in the Basque Country, La Rioja or Madrid.

Finally, although it has been designed to collect more, the tax increase will result in lower disposable income and, therefore, in lower consumption of goods and services, which, in the long run, contracts economic activity. It is very likely that the regional community will lose declarants and especially in the higher income segments, which will result in a fall in revenue. On the other hand, the immediate effect will be to stop the entry of highly qualified human capital. Finally, the reform adds legal uncertainty, since it leads to a vicious cycle: the tax increase will generate more unemployment or contracted consumption, more unemployment or less consumption means lower income, less income implies a greater need for funding and more tax increases, etc.