It seems fair that the richest should contribute more to the tax system. However, this does not mean that you pay a higher tax rate, but a higher percentage of the total “tax pie”, for example, of the personal income tax. In return, those who make less should assume a smaller portion. Starting from these principles that can be considered socially acceptable, it is necessary to propose a strategy to materialize them under two restrictions: on the one hand, the process must be ordered and respect legal security at all times. And, on the other, there must be done everything to preserve the economic structure of the country and strengthen economic growth and job creation.

Following this strategy, how would the revenue from the higher income segments be increased? One route that seems obvious is to raise the marginal types of personal income tax, with the possibility of creating some additional sections. However, it is convenient to review the empirical evidence available for Spain at the present time, in order to assess the impact of fiscal increases made with this same objective in previous years.

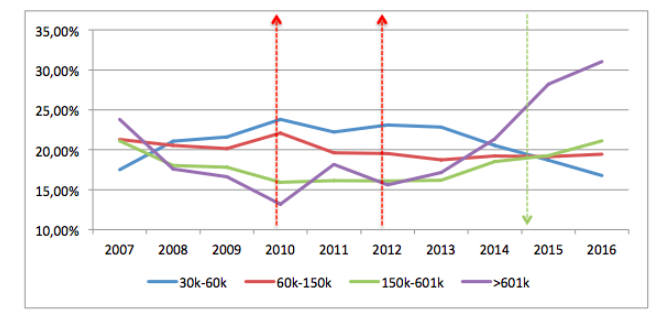

In the last economic cycle, there have been two significant increases which affected the personal income tax. In 2010, in the midst of the European sovereign debt crisis, and then again another in the early days of Rajoy’s Government, at the end of 2011. According to data from the Spanish Tax Authority, in 2010, taxpayers with a liquidable base of more than 150,000 euros —ranging between 0.3 percent and 0.4 percent of total taxpayers— contributed 11.36 percent of the collection. After the tax increase applied in 2011, the contribution of these high incomes experienced a one-off of 0.46 percentage points in the first year, and in the following three years, the improvement was only 0.20 percent.

On the other hand, the weight taxes paid for incomes ranging 30,000 to 60,000 euros per year suffered a 1 percentage point increase between 2010 and 2013, becoming the main victims of both tax increases of the Socialist and People’s Party. The strongest decline in participation corresponded to taxpayers with an income ranging 60,000 to 150,000 euros, who stopped paying 1.78 points of the total «pie.» In summary: the richest 0.3 percent increased their contribution to Treasury by a mere 0.2 percent between 2010 and 2013.

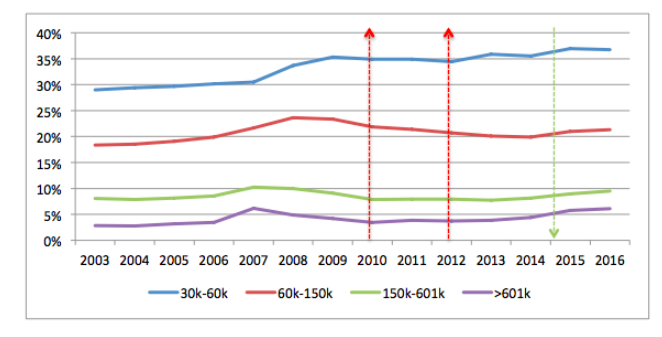

This is the situation regarding income. When in comes to savings, the contribution of higher salaries is much higher, due to the concentration of assets that generate income, interest or dividends that can be taxed. In the first tax change following the outbreak of the 2008 financial crisis, there was a one-off of 5.21 percentage points (from 2010 to 2011), to fall again in 2012. From 2013, in a context of extraordinary recovery of the Stock Exchange and the rest of the assets, both real and financial, the wealthiest —of over 150,000 euros of income— paid almost twice as much as in 2010: the current 52.17 percent which, because of a new fiscal increase, led to the general marginal tax up to 27 percent, although in 2015 it fell to stand at the current rate of 23 percent.

After the strong tax increases made between 2011 and 2012, the contribution of the wealthiest by income or savings stabilized for the highest tranche, and, for those at the lowest —between 60,000 and 150,000 euros—, it continued to decline. This behaviour took a turn in 2014, due to the start of the economic recovery and financial markets, and ought to the decrease in taxes in 2015, which already had some effects in 2016.

Since then, the participation of the richest 0.35 percent has risen by 0.84 percentage points, to 15.59 percent, which is the maximum of the last two economic cycles. That is, those who have more income are contributing more than ever, with substantially lower marginal rates. Thus, when the marginal rate was 52 percent for incomes exceeding 300,000 euros, its participation in the total ranged between 11.56 percent and 12.59 percent. Today, with a marginal tax rate of 45 percent —country’s average, its «piece in the pie» amounts to 15.59 percent.

Therefore, this evidence shows how increasing marginal rates does not necessarily mean that the richest pay more over the total, while other types of measures can achieve this, such as expanding the tax bases formed by senior executives, executives, directors, etc. —90th percentile of employees— of the electricity sector (77,341 euros of gross annual salary), banking (69,872 euros), telecommunications (68,182 euros), or pharmaceutical sector (65,426 euros). In this sense, it is necessary to increase the participation of these high incomes, and reduce the taxes paid for those ranging 30,000 to 60,000 euros. Taxpayers who, to this date, have suffered the bulk of tax increases. To that end, two measures can be proposed:

(i) Lowering marginal rates leads the rich to pay more proportion of total taxes. The reason is that, as the fiscal cost is lower, hiring lawyers and advisors to avoid taxes is discouraged, while the work and the expansion of their businesses is stimulated. Smaller tax rates also increase collection, because the tax bases are greater in times of economic growth.

(ii) Promoting the arrival in Spain of companies and multinationals’ headquarters that increase the base of high-income taxpayers. Attracting senior executives with high productivity would create a stable fiscal framework, not like the current one, which changes depending on the political colour in Government, both of the State and of the Autonomous Communities.

The Government can introduce a condition in this strategy, which is to reverse the rate drop in two or three years if the goal of high incomes to pay more proportion of taxes over the total is not achieved. On the contrary, hardening the levies to obtain greater collection is likely to damage the current economic situation, which is in the deceleration phase of the cycle. Therefore, it is imperative to find the marginal rate of personal income tax in which the percentage of taxes assumed by high incomes is maximized. And there should be assumed that those who earn less, the vast majority of the middle class, would also pay less taxes.

Graph 1. Participation of high incomes in the total collection. Work income

Graph 2. Participation of high incomes in the total collection. Savings income