The main political leaders of our country —President Minister, Mariano Rajoy, opposition’s leader, Pedro Sánchez— have launched a campaign focused on the future of the pension system and long-term savings. Beyond what each of them say about it, it is a great step forward the fact that, finally, these two crucial issues occupy an important position in the public sphere. On the one hand, the President of the Government delivered an important speech at the ABC Forum, where he defended the saving’s state and its forecast as fundamental pillars of the long-term individual and social welfare. He stressed the need to complement the public pensions with private savings: a precautionary measure in the face of future challenges, among which there is longevity.

Regarding the opposition leadership, Sánchez, secretary general of Socialist Party is putting the emphasis on the debate on pensions and, especially, on two essential points: the loss of purchasing power of current pensioners, given that the benefits they receive are no longer indexed inflation and, on the other hand, wage devaluation in the youngest age groups, which generate less income from contributions and which, therefore, could plunge the Social Security system into a structural deficit.

Although, in the first case, Rajoy is right with his defense of family savings —a rare occurrence in a Prime Minister, who finds it easier to speak of a «culture of spending» than of a «culture of saving»—, he has not still proposed a political guide aimed at adapting the economic and social structure of Spain to the challenge of prolonging the lives of people, together with the sharp reduction in birth and fertility rates.

According to demographic statistics, specifically data from the last Municipal Register (2015), since 1960 the population over 65 years of age has more than doubled, and it already represents 20 percent of the total population. At the same time, the percentage of young people aged between 0 and 14 years has been reduced by almost half, with a weight on the total 4 points lower than the population over 65. As if that were not enough, the World Health Organization ( WHO) predicts that, by 2050, there will be more than 2,000 million people over 60 years old, which is almost three times the number of the year 2000.

Key issues of the latest pensions reform

The Government has recently approved a package of measures that modify the current legal regime of one of the most popular vehicles for long-term savings: pension plans. Since the creation of Law 8/1987 of Regulation of Pension Plans and Funds, these have been designed to cover contingencies such as retirement, widowhood, survival, orphanage, permanent disability, dependence, serious illness, long-term unemployment and death.

Faced with one of these situations, people receive a benefit payment in an amount that will depend on the capital they have previously contributed with and the returns obtained throughout the years of contracting the plan —technically known as «consolidated rights». This benefit was conceived from the beginning as a supplement to the public pay-as-you-go pension, but, given that estimates indicate that it will suffer a sharp reduction after 2025 with respect to the current average pension, it will de facto partially replace the loss of purchasing power.

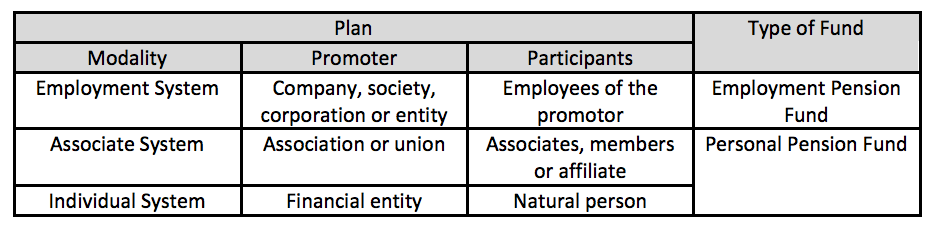

Table 1. Type of pension plans according to pension promoter

Over the past few years, the figure of the individual contribution pension plan —there are also those of companies and associations, but which weight less in the whole system— has become a highly regulated vehicle in the way it operates, both for promoters of the plans and for the management entities and the participants themselves. In the case of the latter, they can not recover the consolidated rights —contributions + profitability— unless:

(i) Any of the contingencies susceptible of coverage in a pension plan is produced: Retirement, total permanent disability for the usual profession, absolute for all work or great disability, death of the participant or beneficiary, being able to generate entitlement to widow’s benefits, orphanage or in favor of other heirs or designated persons, severe dependence or great dependence on the participant.

(ii) There is an exceptional situation of liquidity that is contemplated in the specifications of the plan: Serious illness accredited by the Social Security authority, long-term unemployment, eviction, seniority of more than 10 years. In this case, the amount of consolidated rights can be recovered after 2025.

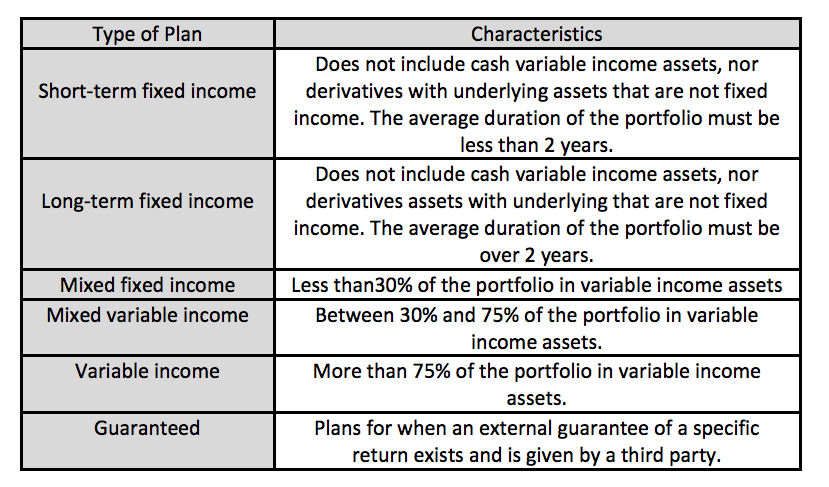

The latter is the most recent modification, included by Rajoy’s Executive. With regard to the managers and plans’ promoters, rigidities come both from the portfolio side and from the management costs incurred. On the one hand, the law contemplates different types of plans, with different liquidity requirements, type of assets, associated risks and other characteristics. The following table summarizes the types of pension plans existing in the Spanish market:

Table 2. Types of pension plans

On the other hand, pension plans are framed in a regime of maximum commissions. As of the last reform, taken to Rajoy’s Cabinet on February 9, 2018, the maximum average commission is 1.25 percent —lower than the previous percentage of 1.50 percent. In the case of fixed-income funds, the maximum is 0.85 percent —0.65 percent lower than in the previous reform in 2014—; a ceiling of 1.30 percent for mixed funds —0.20 percentage points less—; and remains invariant at 1.50 percent for equity funds. Finally, the maximum deposit fee of 0.25 percent to 0.20 percent is reduced.

In exchange for these rigidities, and to popularize this setting, the new regulation granted two important advantages to the participants: a taxation apparently advantageous in the contributions —but very harmful in the collection of benefits—, and the right of transfer without any tax cost —in other words, without having to pay— from one pension plan to another by unilateral decision of the participant, as happens with investment funds. The first one is especially relevant, as it allows a tax deduction of the contributions made individually to a pension plan, up to a maximum limit, in the General Tax Base of the Personal Income Tax (IRPF in Spanish). Thus, savers normally benefit from a reduction of up to 8,000 euros per year per participant, which helps in many cases to «jump down», benefiting from a lower effective rate than to that which would correspond to them otherwise.

Due these and other advantages, pension plans have become very popular among the Spanish society, accumulating increases in equity year after year, as shown by the latest figures from the investment fund and pension funds Inverco, which registered, by the end of 2017, a total equity of 74,377 million euros under management in individual plans —+ 5.52% from the previous year— and a total of 7,633,830 participants. As a result, today’s penetration of this type of pension plan has made pensions very similar to long-term savings and, therefore, any change in their legal or tax regime has a wide impact on savers, as seen below.

Lower commissions and liquidity. Fostering long-term saving?

The new amendments contemplated in the latest Decree of pension plans —which enables a window of liquidity at ten years and a reduction in average management commissions to 1.25 percent on equity— tarnished rather than clarified the debate, as these refocus it on the issue of pensions —position also held by Pedro Sánchez—, when aging is much more than that. This window of liquidity in the pension plans system is not a good measure, as it imposes an additional restriction on a model that is already very limited and restricted. A window of liquidity at 10 years is an important additional cost for any pension plan, since it has to buy liquidity hedges to cover the risk of a participant wanting to rescue at any time. This alters the nature of the portfolio, which is usually built over a very long-term horizon.

Therefore, offering liquidity always implies undoing the portfolio, having higher liquidity ratios or buying IRS that mitigate the risk involved. The additional costs that this entails must be passed on to the client, in the form of a higher management fee or results. However, as at the same time, the maximum management fee to be charged at 1.25 percent on equity is reduced, it becomes a loss for the manager, which cannot reflect this increase in costs. By virtue of this, the incentives are clearly directed to rotate the portfolio very little —as each time this is done there are brokerage expenses that cannot be attributed to the participant— and, therefore, managers end up doing a totally passive management which leads to low profitability. To make matters worse, given that the investment is very conditioned by the corsets that the regulation establishes according to the type of plan —the vast majority are fixed income, guaranteed, and mixed fixed income, just the products that have a worse horizon medium term if interest rates rise—, the result for the client oscillates between low, zero and even negative nominal returns. This is, ultimately, the reason why there are no good pension plans in Spain and very few manage to beat benchmarks. As stated in its annual study, Fernández et al (2018), only 4 of the 356 pension funds with 15 years of track-record beat the IBEX 35, and 47 the 15-year government bonds.

Finally, given the tendency in Spain to low savings —the rate, as a percentage of the disposable income of families, barely exceeds 5 percent—, allowing a plan’s rescue after 10 years encourages spending and favors the Treasury, as all the rescued amounts have to be taxed with income tax and, most likely, at a much higher rate than it would be if it were treated as savings income. This tax toll is ought to take into account, and yet it is fairly unnoticed. Therefore, planning the moment of collection of benefits is crucial: the difference between rescuing a pension plan in the form of capital —full rescue— or in the form of income —partial rescue, with charges, for example, monthly— can amount to many thousands of euros. For example, a beneficiary of a Pension Plan that has accumulated 500,000 euros of consolidated rights, of which 100,000 correspond to contributions before 2006, and with a Social Security pension of 12,000 euros per year, may have to pay, if it rescues in the form of capital, more than 200,000 euros in taxes. On the other hand, if it were to take everything out in as income for more than 25 years, it would be less than 60,000 euros. It is an astronomical difference for a regular retiree.

Pension and savings plans at the regional level

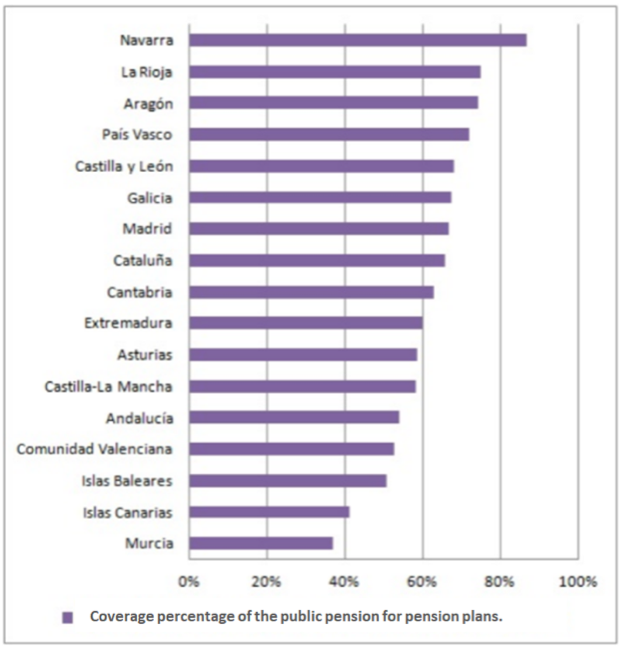

All the aforementioned fiscal and regulatory barriers discourage even more the already precarious basis of family savings in Spain. This, together with the preference for property-based housing and the role given to the State as a pension planner and provider, the economy faces extraordinary barriers to face the risk of longevity with little to no safeguards. With the latest data published by Inverco (2016), it can be verified that all the money saved per capita in the form of pension plans would not cover even one year of pension. Thus, the families of Murcia and the Canary Islands could barely finance 40 percent of the one-year pension with the amounts saved, followed by the Asturians, who could get 58 percent. On the other side of the scale we find Navarre and La Rioja, where the money accumulated over the years in one of these plans would give pensioners 87 percent and 75 percent respectively, of their annual pension. But, in any case, no Autonomous Community would be able to «reach the end of the year» with the money saved.

Graph 1. Average equity per pensioner and average public pension (2016)

Conclusion

Before this enormous challenge of the future, it is not possible to make isolated decisions that, however well-meaning they may be, do not help to point out a clear diagnosis and specific solutions. It is quite «populist» to promise reductions of the pensions’ commissions, when, right now, its only advantage lies in the relief for contributions of over 8,000 euros. A measure that would not work out in nearly 700 pension plans that, today, are traded in the market.

References

Fernández, P., Fernández-Acín, P & Fernández-Acín, I. (2018) Return of Pension Funds in Spain (2002-2017)

Fundación de Estudios Financieros & Fidelity International (2017). Longevity and changes in savings and investment

Inverco (2017). Pension funds participants

Pomés, J. (2018). Insufficient savings, poor retirees

Vázquez, S. (2018) Are pension plans a fraud?, La Voz de Galicia, (February 2018)