If there is one topic related to politics and economics that has been talked about at length over the last few months and years, it is Brexit. Extensive academic work has been published on it, and litres of ink have been used to try to explain a process of breaking with the EU that may be very difficult to understand. This misunderstanding has led to great economic and financial uncertainty over the last three years. IN a scenario of European slowdown like the present one, with central banks that have exhausted all their gunpowder and reheated their weapons, and with the main Member States refusing to carry out far-reaching structural reforms and relying entirely on the everlasting policy of spending, the Brexit becomes much more complicated and problematic.

The effects it could have (many of them are already being observed) on the British economy have been pointed out on many chances, but we mustn’t forget that the other EU countries are also involved in this process, as they are direct or indirect trading partners of the United Kingdom. Therefore, all the governments interested in attracting part of the foreign capital that would leave London after the exit from the EU are designing strategic plans to flavour direct financial investment. The implementation of such plans could be much more complicated in a tough Brexit situation, not only because of the aftermath but also because of the political uncertainty and instability that have been the hallmark of the process of breaking with the EU since June 2016. Do we really know the repercussions?

In recent months, the European economies have generally experienced a contraction in the rate of job creation and a clear reduction in the volume of investment. The United Kingdom hasn’t had a better run of luck and, mainly due to the uncertainties surrounding it, has seen the growth of its direct financial investment volume decrease by 6% and the generation of employment by 1,5%.

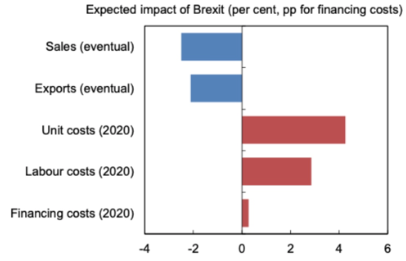

Business uncertainty in the UK has been at an all-time high for over 10 years, coinciding with the global financial crisis of 2008. According to a Decision Maker Panel survey, after Brexit, companies expected their sales to fall by around 2.5%, which would be compounded by a reduction in exports, and an increase in unit, labour and financial costs. According to the data available, the latter have increased by nearly 4% until 2020, while sales abroad have contracted by more than 2%. These figures reflect a clear negative scenario for the British economy with collateral effects on investment and the pace of job creation. But how do we know that these numbers are a product for uncertainty and not simply the continuation of the economic cycle?

Three economists (NIcholas Bloom, Scarlet Chen and Paul Mizen) have recently published a report entitled Rising Brexit uncertainty has reduced investment and employment, in which the pernicious economic results of the process of breaking with the EU can be seen very clearly. They have analysed in an extensive econometric work the changes in the volume of investment and employment, and have linked them to 3.000 British companies exposed to different levels of uncertainty (since the effects of the brexit are not the same in a company that mainly exports to European countries as in a small company that lives off domestic demand). The study suggests that pure political uncertainty could be related to a fall of around 6% in investment volume.

FIgure 1: Expected impact of Brexit (per cent, pp for financing costs)

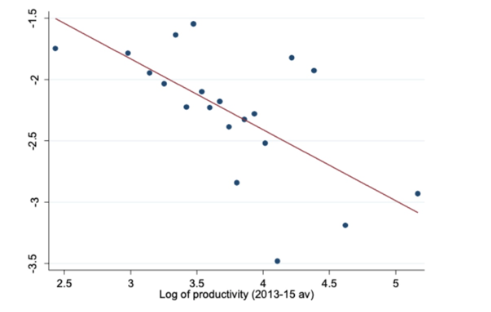

In a process of structural change in the economy such as the one we are experiencing today, the most relevant thing for a country must be to maintain (or increase) the level of productivity, which, in turn, is highly linked to innovation and development of new products and production processes. It is therefore of great concern that the United Kingdom is currently suffering from sharp declines in its productivity levels. The effect is most noticeable in those companies that export, import components, or finance themselves through other EU countries. It’s agreed that these companies are also the ones with the highest level of productivity, according to the historical series. Therefore, if they see it reduced, this will generate an amplifying effect on the total of the British economy, and therefore, the European one. Estimates show a reduction in British productivity of 0.5% per year; taking into account that it has only grown by 1% over the last few years.

Figure 2: Expected eventual impact of Brexit on sales versus productivity

And how does all this affect Spain?

It will be surprising to learn that the effects of Brexit on our economy could be far greater than expected. Not for nothing is the United Kingdom the fifth largest investor in the Spanish economy, with a volume of 63 billion accumulated over eleven years. Moreover, 46% of the direct financial investment that the British receive comes from EU countries, and the very functioning of its financial framework encourages that monkey to be channelled to projects in other States. Therefore, after Brexit, the island’s investment in Spain would be substantially reduced.

Spain must be alert to the opportunities for attracting foreign capital that may arise from the Brexit

With regard to tourism, the impact would also be very damaging, since, every year, around 16 million British tourists choose our country as a holiday destination. A tightening of the conditions for visiting EU countries would cause a sharp fall in the volume of travellers of this nationality in the coming years. For all these reasons, Spanish administrations such as the Andalusian Government recently published a strategic programme of measures to promote the attraction of British capital. Some of these could be enormously useful in guaranteeing security and stability to investors, such as individualised legal advice to foreign companies settling in Andalusia, greater investment in R&D through a Logistics Innovation Centre, or different tax advantages that would be offered to British companies and workers, thus encouraging their decision to settle in Andalusia (or other regions in Spain with similar strategic plans). The problem is that such plans are made on a quicksand basis, as the final outcome of this breaking process is unknown. Therefore, designing large programs (with their corresponding burden on the Treasury) can even be counterproductive for the Spanish economy. Strategic plan to promote the attraction of capital, yes. Megalomaniacal public spending plans, no.

To sum up, the uncertainty and instability around Brexit is at its highest, with the consequent economic repercussions. Therefore, Spanish administrations must be alert to consequent economic repercussions. Therefore, Spanish administrations must be alert to new opportunities for attracting foreign capital that may arise from this process. It should be remembered, however, that the economy is driven by incentives, and greater public spending in this regard would only represent a new obstacle.