INTRODUCTION

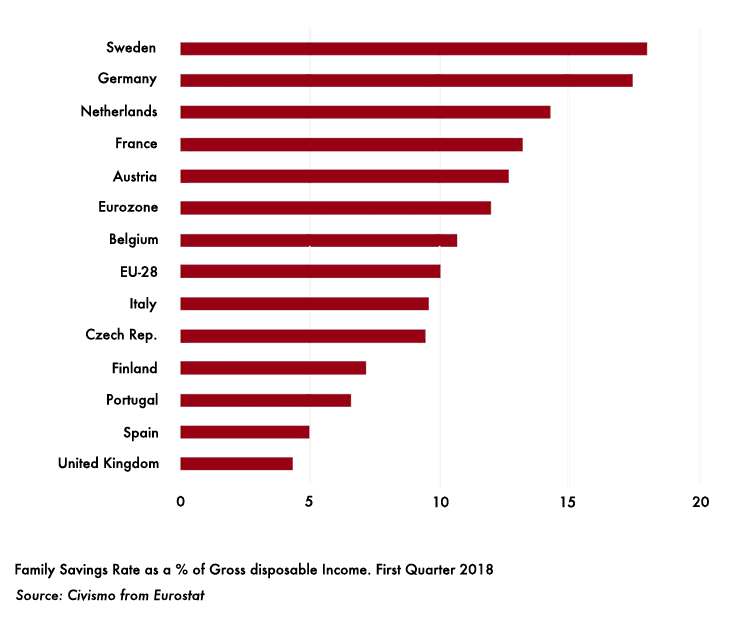

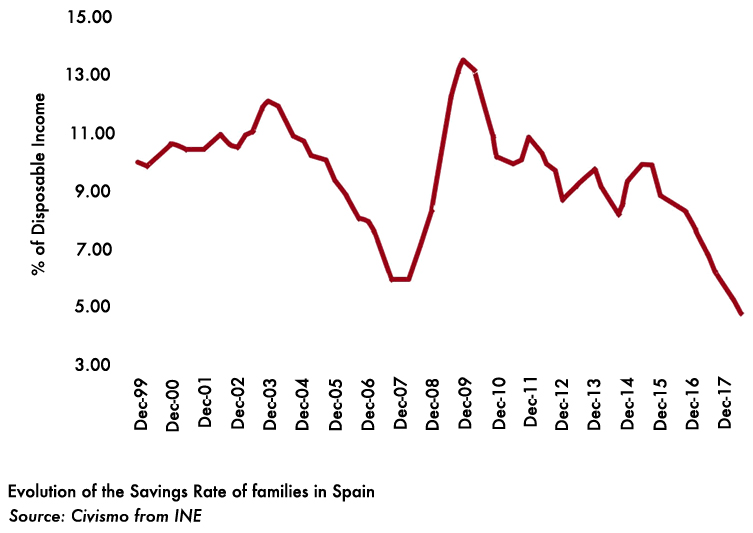

The latest publication by the National Institute of Statistics (INE) has once again revealed one of the most worrying realities of the Spanish economy: the permanent and sustained drop in the savings rate of families. In terms of disposable income and quarterly moving average, Spanish families barely save 4.7 of every 100 euros of income at the end of the second quarter, which puts them in the worst position in the entire Eurozone and in the second worst position at European level, only behind the United Kingdom and with a difference of almost 7 percentage points compared to the Eurozone average (12 percent). Far away are countries such as France (13.18 percent), Germany (17.41 percent) or Sweden (17.97 percent).

Why are families unable to save more? What causes are behind the family savings rate in Spain being systematically lower than the European average? These are fundamental questions that need a clear and concise answer, given that over time this situation has constituted an element of clear weakness of the Spanish economy.

THE STATE OF SAVINGS IN SPAIN

The data published by the National Statistics Institute (INE) corresponding to the Quarterly National Accounts of the Institutional Sectors of the second quarter of 2018, reveal one of the most important imbalances in the Spanish economy, such as the drop in the family savings rate , which joins the public disaster that continues at high levels. This contrasts with the reality of the challenge of institutional sectors, which continue to save and generate higher margins despite the slowdown in the Spanish economy.

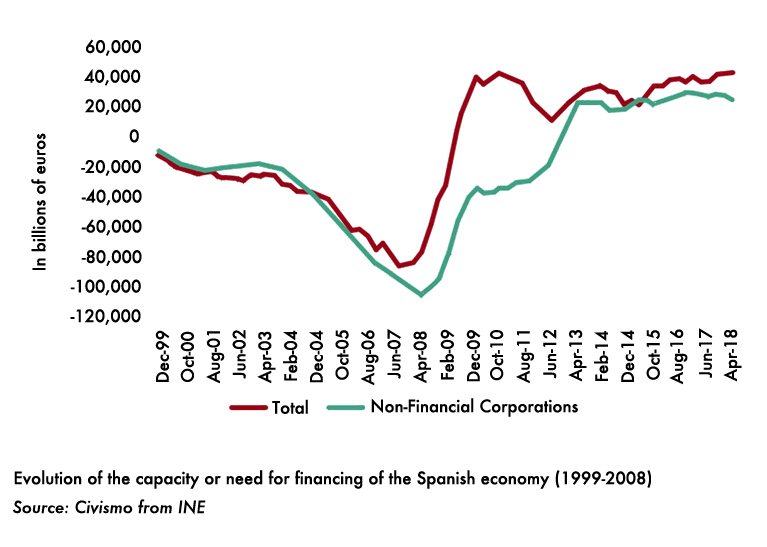

In general terms, Spain is managing to maintain its financing capacity, reaching 22.917 million euros in the annual accumulated until June, 1.87 percent of GDP, although it is significantly lower than a year ago when between the third and fourth quarter of 2017 Spain reached the peak of the historical series (26,646 million euros in December).

While the increase rate in total net savings is maintained in companies, financial institutions and public administrations, the family surplus suffers an extraordinary drop, passing in cumulative terms of having a financing capacity millions of euros in June 2017 to a need for Current financing of 13,168 million euros, 1.11 percent of GDP, which necessarily represents a rise in debt as can be seen in the latest data published by the Bank of Spain. In terms of gross savings, families have reduced it by 31.38 percent to 33,672 million euros, half that three years ago and two thirds less than at the peak of savings marked in 2010.

With a growth rate of 2.7 percent according to the INE, the Spanish economy is entering a phase of deceleration of the cycle, adopting a different trajectory to the one that it traveled in recent years when for the first time in its history it grew above 3 % real generating surplus in external accounts. We will see how little by little the national savings and total investment rates suffer, which in 2018 is expected to increase the investment rate (0.62 percent of GDP up to 21.76 percent) and a slight drop in the rate savings (0.1 percent of GDP up to 22.92%) according to IMF estimates. Consequently, the balance of current operations will remain positive and equal to 1.16 percent of GDP. In that sense, the repetition of the pattern of family dissaving (as happened from March 2004) calls into question the fundamentals of growth, both from the point of view of the strength of the engines of the Spanish economy and for what is happening with variables as important as savings or investment.

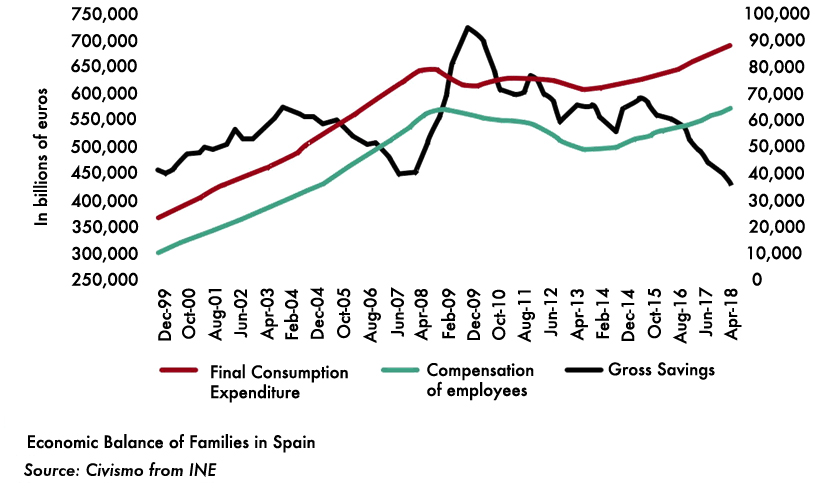

CYCLIC FACTORS IN THE DECREASE OF SAVINGS

In the short-term, Spanish families are reducing their savings due to an increase in consumption above their income since the beginning of the expansionary phase of the current economic cycle. Thus, while wages measured in terms of National Accounts (only full-time employment are computed) grow at an accumulated rate of 3.7 percent per year (undoubtedly influenced by the “substitution effect” in the labor market among former undefined workers full-time by others also indefinite but part-time), the consumption or expenditure on final consumption of households grows at 4 percent at the end of June. And, therefore, given the weight of consumption over disposable income, gross savings falls above 30 percent.

Throughout the upward phase of the economic cycle that began between the third and fourth quarters of 2013, consumption has always overreacted to wage growth. Specifically, for each percentage point of salary growth (in the previous sense of National Accounts), consumption increased by 1.05%, which represents an overreaction of 5%, thus being a variable that is substantially elastic to the growth of income and, therefore, of the Spanish economy. However, saving has not followed a similar pattern and may have taken advantage of wage growth, but quite the opposite: savings rose by “precautionary reason” suddenly and very strongly at the beginning of the crisis and subsequently began a downward trend to the current levels.

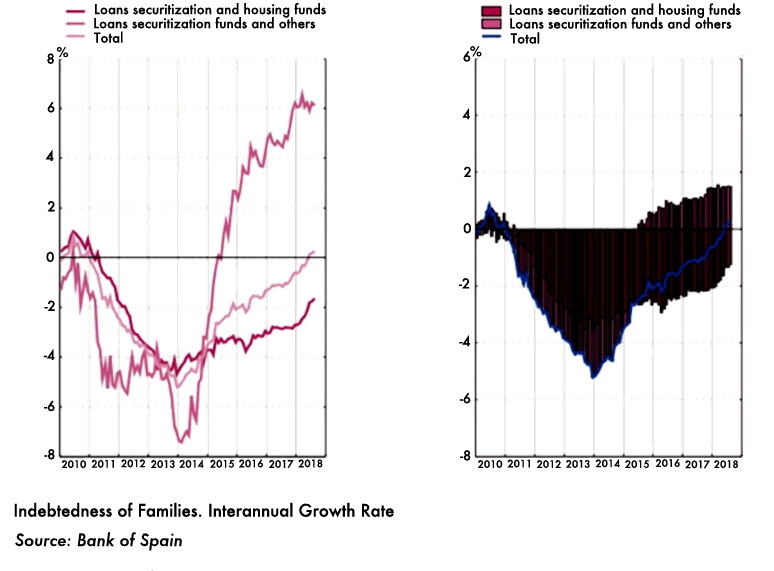

In other words, families are consuming above what their income allows and therefore the only way to finance this behavior is «burning» savings or also increasing their indebtedness via consumer credit and other financial facilities such as the data of the Bank of Spain show: until August, the annual growth of the debt stock through this type of loans is 6.1 percent internal (paying vacations, cars, extraordinary expenses …) counteracted the fall of the stock of credit for housing and returning for the first time since 2010 the total rate to positive ground (+ 0.3 percent).

Not only the evaluation of disposable income, the years of a deep economic crisis, determines the behaviour of consumption and savings in cyclical terms. Given the greater multiplier of consumption, there are factors that explain this situation. These are the following:

a) The agents’ temporary preference: The consumer discounts the present much more with respect to the future than before. After years of crisis, the consumer is more «impatient» or more «short-term».

b) Falling interest rates: The avalanche of liquidity in the markets and the revival of consumer credit is enabling families to finance current spending as can be seen in holiday or shopping campaigns. The more the interest rate falls, the more the consumer wants to advance future consumption to the present, which will force him to save in the future.

c) The future expectations of the economic situation: The improvement of the main macro variables (except savings) lead the consumer to form much more positive expectations than a few years ago.

The simultaneous performance of these three variables will be significantly modified as families less discount the present due to the exhaustion of the expansionary phase of the economic cycle and the slow normalization of monetary policy. Even so, the macro trends revealed by these numbers, especially savings, have a high probability of continuing in the near future, with a weak point that is not exactly trivial: saving. Without savings there is no investment and without investment, there is no long-term sustainable growth.

STRUCTURAL FACTORS IN THE DECREASE OF SAVINGS

Cyclic factors do not precisely contribute to a sustained increase in family savings. But where the biggest problem is and the one that makes saving the weak point of the Spanish economy is undoubtedly the structural factors. When it is argued that low wages prevent saving, it is evident that this is a temporary factor, since in the years in which wages grew by agreement above 5 percent, the family savings rate marked all time lows.

How can such a structural hole be explained? In the first place, it is necessary to turn to the so-called “life cycle theory” in order to establish an orderly framework of analysis and from there infer the factors that structurally affect saving. Nobel laureate Franco Modigliani was the one who laid the foundations of this theory, which has become one of the fundamental frameworks to explain the reasons that drive a person to save. This has been used to analyse the importance of social protection systems and in particular pension systems globally.

According to this theory, an individual saves for three main reasons: to finance his training and that of his family; as a forecast for potential incidents (with special attention to housing as «long-term» insurance) and especially when the time comes for retirement. According to these premises, the beginning of the person’s working life is characterised by negative savings rates, that is, by indebtedness. Later, you save more and more until you reach the end of your active work or business life, in which your savings rate becomes negative again because the accumulated resources are used to finance your expenses thereafter.

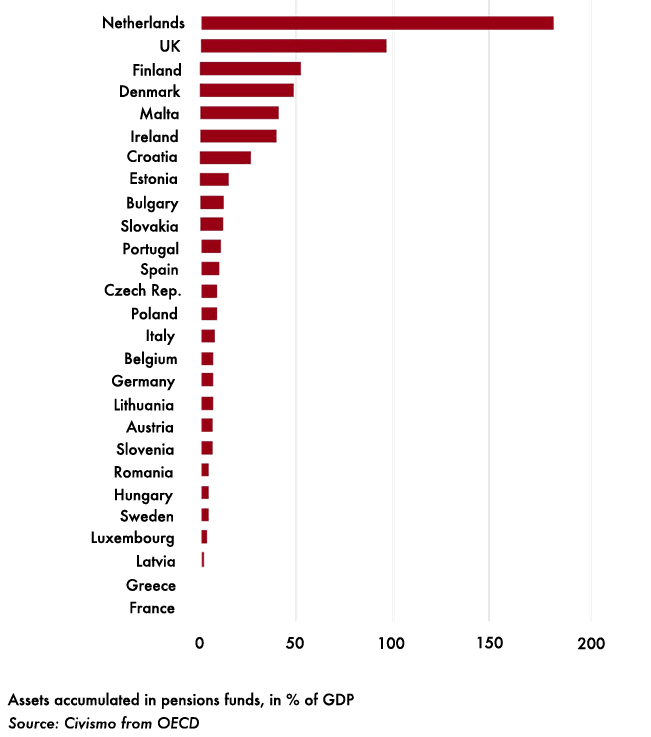

Therefore, if the State is responsible for providing all resources at the time of retirement and if it is also responsible for financing education on a public or concert basis, the theory indicates that the level of overall savings of this economy it will be lower than in other countries where the State does not guarantee pensions or where social security has a mixed nature (combination of a first pillar based on public pensions with a second complementary pillar based on private pensions, especially corporate-based ones).

This is exactly the evidence available to Spain regarding its European partners. In countries where there is a public distribution system such as Spain, it structurally generates lower family savings rates and higher public pensions in relation to the last salary received. That is, the distribution system encourages the generation of income present against the ability to generate future income via financial income or availability of money saved.

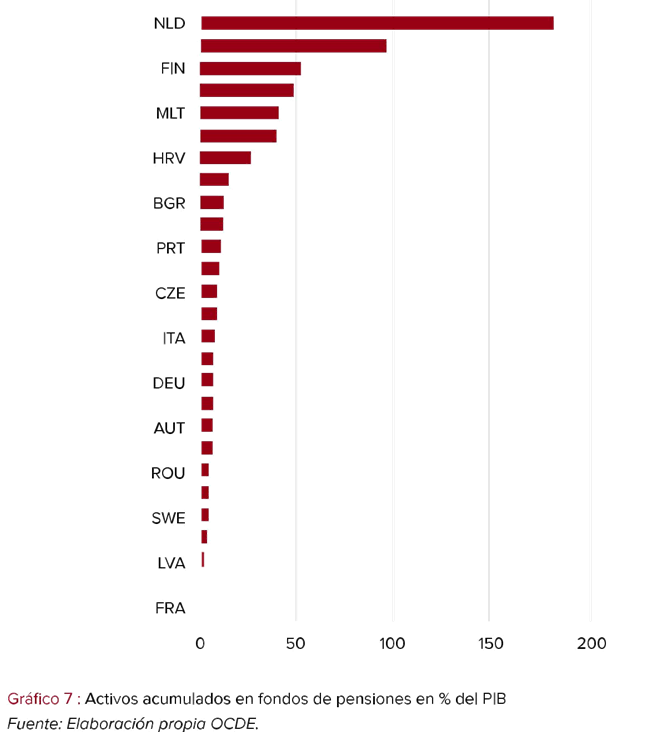

Thus, the accumulation of assets to deal with retirement is much lower than in other countries where there is a complementary forecast or there is a capitalization system. Taking the latest OECD data for 2016, a great difference can be seen in the size of pension funds at European level, leaving aside the assets accumulated by the State itself in notional account regimes such as Swedish or public capitalisation like the Polish.

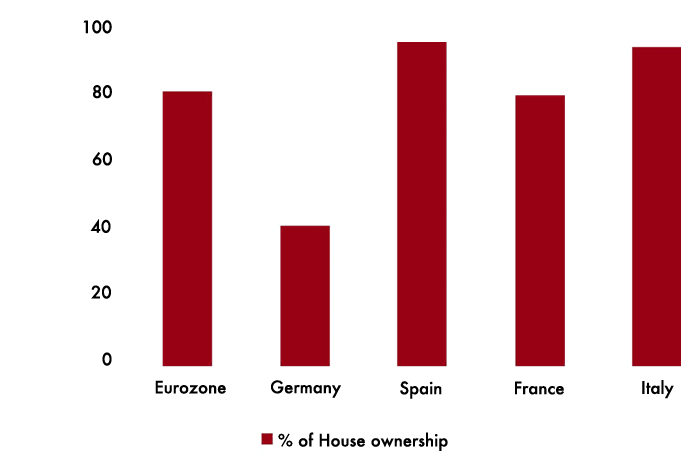

Secondly, given that the State is responsible for the provision of both education and retirement, the only pillar of provision that remains in the hands of families is that of unforeseen events, especially the provision of housing. In this regard, Spanish families make a considerable financial over-effort throughout their lives to acquire a property home, which «mortgages» their life cycle. Thus, 63 percent of Spanish families systematically spend more than they enter throughout their lives, the main reason being the purchase of habitual housing. This leads to Spain being the country where the proportion of families that own property is the highest in the Eurozone.

Third, demographic factors such as the phenomenon of longevity alter the composition and generation of intergenerational savings. Currently, in Spain, low birth rates reduce the number of individuals at young age, and the extension of life expectancy increases it in old age. There is a progressive aging of the population that generates possible difficulties for future public benefits and therefore, greater awareness to save and thus privately supplement the public pension. Even the most recent demographic projections by 2050, call into question the future capacity of the State to cover pension commitments, which should be an incentive to plan savings and investment.

Finally, the tax and inheritance variables play a fundamental role in explaining the low volumes of savings. The Spanish tax system penalises and discriminates savings with multiple taxes, among which taxes on income from savings within the personal income tax, Patrimony, Inheritance and Donations, IBl, among others taxes. Spain is one of the few countries in which it virtually taxes flows (capital income) even without avoiding double taxation with Companies (the exemption for dividends was eliminated) than the stock (capital gains, equity and IBI). But also, at the same time, it applies the second highest social contributions of the OECD only behind Sweden, with a “tax wedge” on gross labour income of 38.34 percent for 2018.

In light of this data, in sum, a system as dysfunctional as the current one requires the implementation of financial instruments in which citizens can place the savings generated for the purpose of the forecast, and that are structured with a vision to long term. In this sense, the «life cycle theory» allows you to set the investment objectives as the individual is in one of the three stages or phases of his life described. From this, the role of the financial system is to categorise customers and therefore offer products with levels of risk appropriate to their situation in the life cycle. This is the current challenge that is not without difficulties, since in most cases it is necessary to work on people to discover their true financial needs, which in many cases they are not even aware that they have them.