Introduction

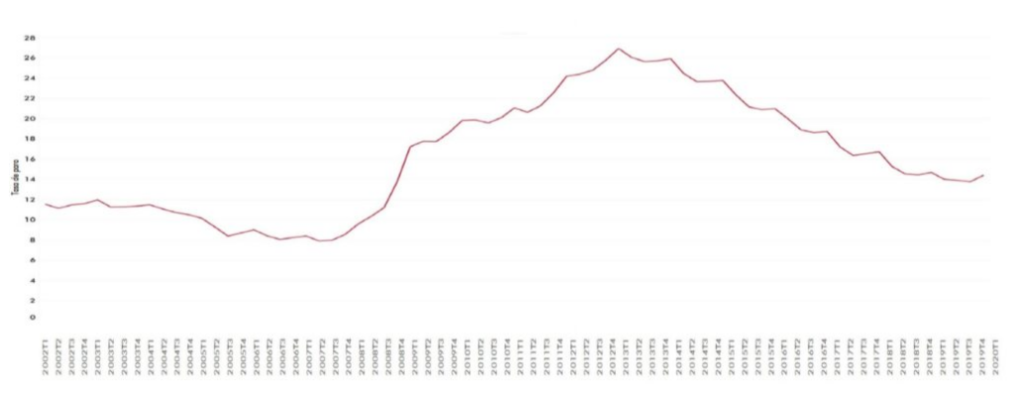

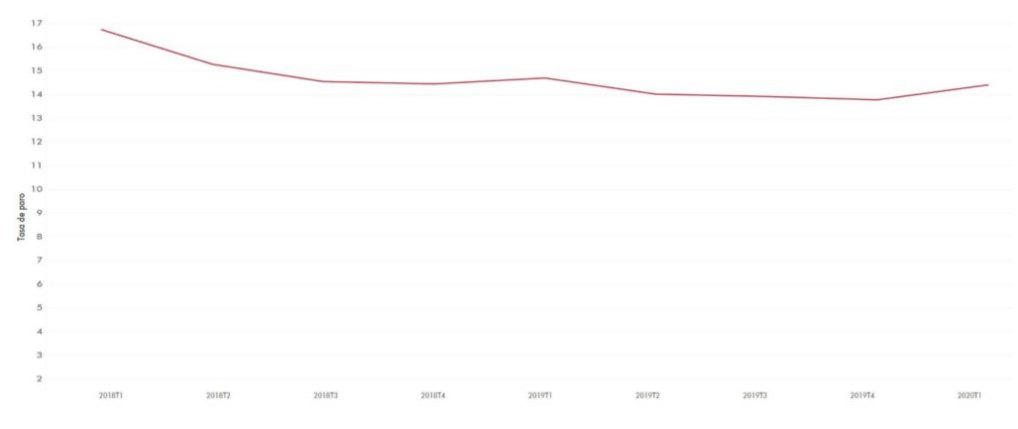

After the state of alarm decree on March 14 in the face of the COVID-19 crisis, a disease which proved extremely contagious, social distancing measures and the confinement of the population forced the closure of all non-essential activities and Spanish companies in order to reduce the infection rate. Uncertainty and precedented events did not help to contain the situation. The Government then saw the need to apply a series of measures that, in the face of the negative supply shock that the economy was experiencing, intended to mitigate the possible effects of this forced closure of the labour market. With the high level of unemployment that already existed in the country, paralysis of activity became the greatest threat to the stability of countless jobs. Thus, with 14% [1], the Spanish economy became the country with the second highest unemployment rate in the European Union [2], second only to Greece. Spain, therefore, faced the difficult dichotomy of saving lives or employment. At this crossroads, it failed in favour of health care and medical care, despite pessimistic forecasts about the possible economic consequences of containment measures.

Graph 1. Evolution of the unemployment rate (Firts quarter of 2002 to the first quarter of 2020)

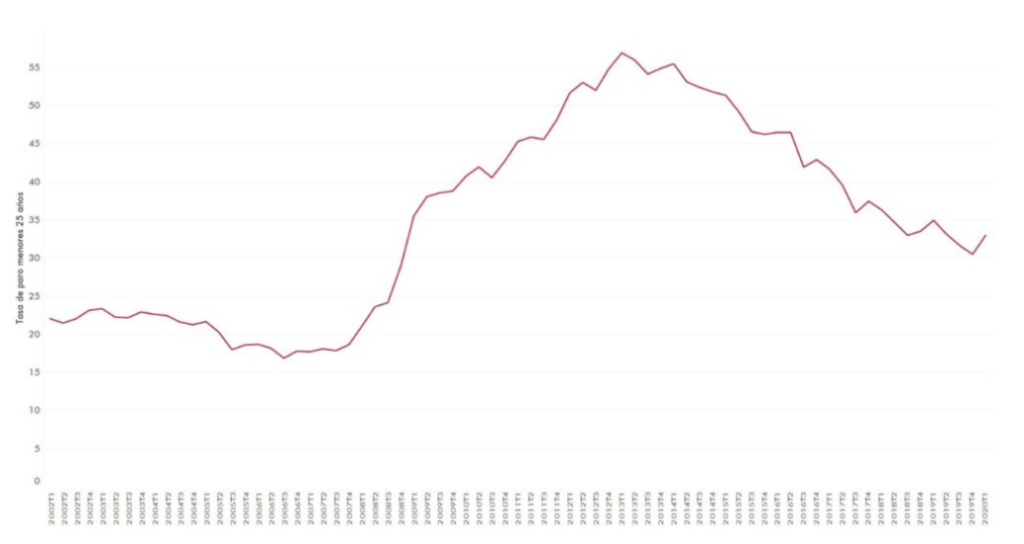

To understand the context, it is necessary to contemplate Spain’s situation and its labour market before the coronavirus appeared on the horizon. For example, youth employment had the lowest levels in the European Union, with an unemployment rate of 33% [3]. In other words, the situation among those under the age of 25 was even worse than in the general radiography; these young people represented a great drag on the labour market, which was unable to provide exit to university graduates, who settled for low-skilled employment in the absence of opportunity.

Graph 2. Evolution of the unemployment rate among those under 25 years of age (First quarter of 2002 to first quarter of 2020)

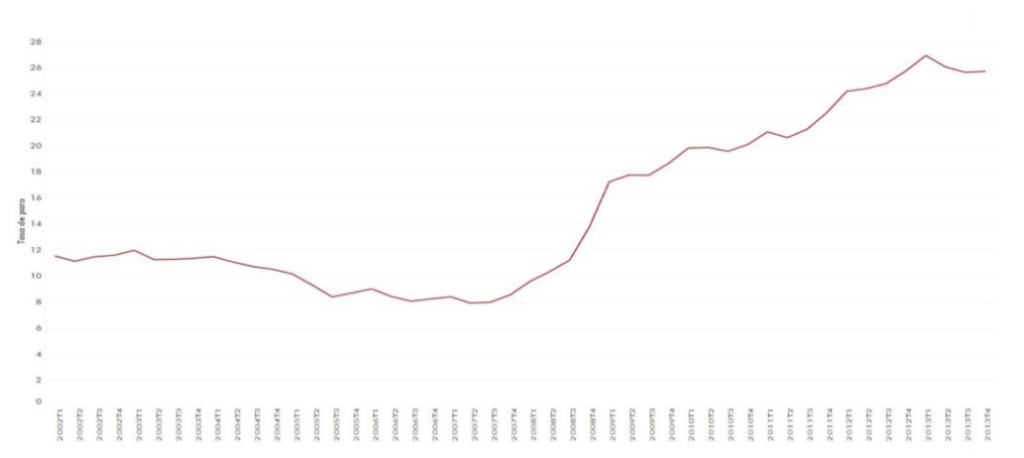

As the statistics reflect, the Spanish labour market is quite complex. Before the 2012 reform, the average unemployment rate, according to historical data, was 17% [4]. Its lack of flexibility, accompanied by crisis, led to inevitable job destruction, which forced the country to adopt structural reforms that would contain the disappearance of productive capacity.

After the reform was implemented, numerous studies concluded that it did not generate higher value-added employment, since the introduction of flexibility in the labour market created a massive shift in permanent employment, which was relocated to temporary employment. However, studies by BBVA Research indicate that the flexibility that the labour reform brought to the Spanish labour market, as well as the wage moderation pact for unions and employers for the period 2012-2014, avoided the long-term loss: up to 1.5 million jobs and a rise in the unemployment rate of more than six points [5]. The rigidity which the market previously displayed was generating an average unemployment rate which was not only excessively high, but also structural.

Graph 3. Evolution of the unemployment rate (First quarter of 2002 to fourth quarter of 2013)

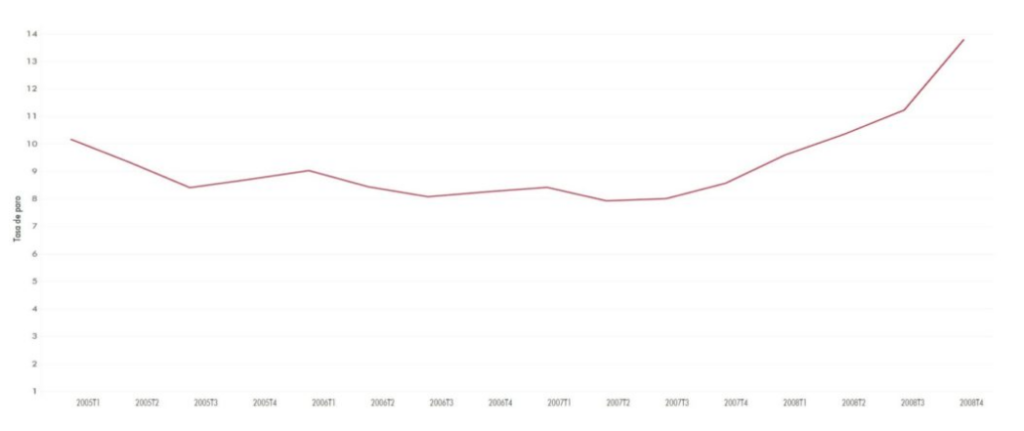

The Spanish economy began to create employment in this manner, although, as previously mentioned, it was of lower quality. However, this sacrifice was necessary, considering that the best unemployment rate in our democratic history was 7.9% [6]. After reaching a peak close to 23% [7], it began to decrease progressively, until reaching current levels.

Graph 4. Evolution of the unemployment rate (First quarter of 2005 to fourth quarter of 2008)

Recently, efforts having focused on reversing one of the fundamental pillars of the labour reform by trying to increase the rigidity of the labour market. This has sparked numerous criticisms in a context of a clear trend of slowdown in the economy, as indicated by the International Monetary Fund (IMF). A slowdown that he called «synchronized» [8] for affecting 90% of global economies. A cooling and a slower pace of job creation than Spain could not afford given the aforementioned structural unemployment that afflicts it and which, from the European perspective, leaves us in a very bad place.

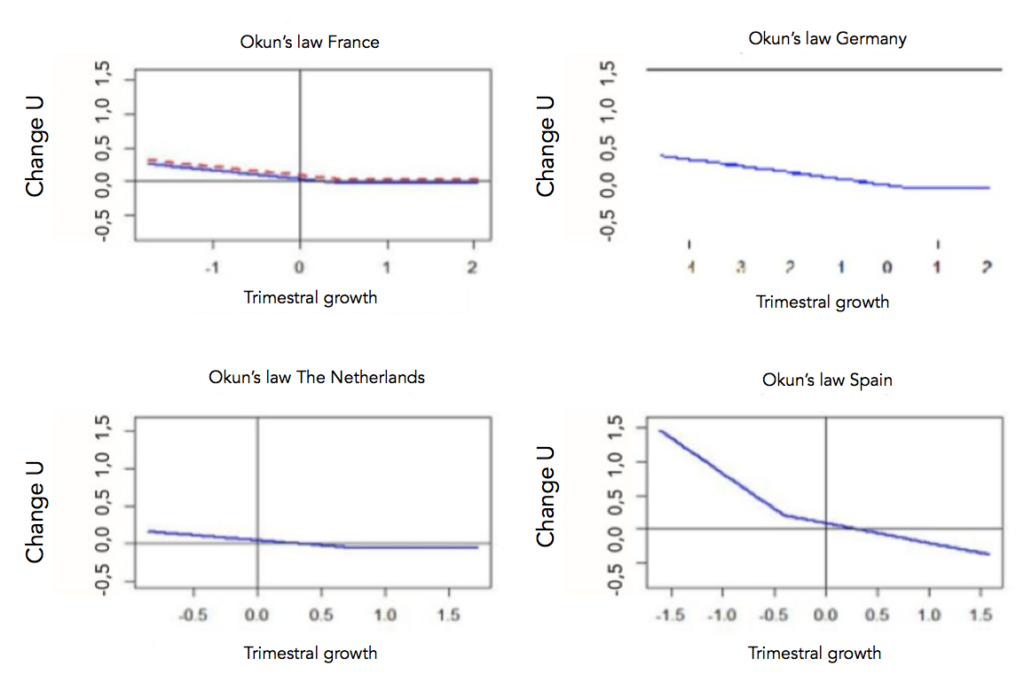

The peculiarities of the behavior of our labor market, reflected in the curve shown by Okun’s law, seriously endanger the Spanish economy. This law is in charge of measuring the relationship between growth and employment, and it is very useful to study its evolution over time and its comparison between countries, since it produces very interesting conclusions on the functioning of labor markets.

Thus, the behavior of the Spanish economy reveals a greater sensitivity of employment to variations in economic growth. In other words, when it exceeds the 0.3% threshold, jobs begin to be created at a higher rate, due to its high structural unemployment rate. And vice versa: when Spain exceeds its threshold, which is in negative terrain (-0.41%), our economy, due to a series of factors included in the academic portal «Nothing is Free» [9] (especially , the high rate of temporary employment) begins to destroy employment more intensively than other European economies.

Graph 5. Comparison of Okun’s law between countries (Spain scale)

For this reason, as the aforementioned study shows, risk aversion in Spanish companies is more intense than in other countries. On the other hand, the type of negotiations between unions and employers in the Spanish labour market makes it easier to adjust amounts according to possible variations in wages and hours worked. Finally, as mentioned, this peculiarity in behavior can be explained by the vast predominance of temporary jobs (30% of hiring) and part-time jobs in the Spanish market after the labour reform, which imply much lower layoffs than permanent jobs.

For this reason, in the face of the crisis caused by the coronavirus, Spain was forced to apply regulations that would facilitate the adaptation of companies to the new situation. This peculiarity of our economy, in a scenario in which the projected year-on-year contraction moved between 6% and 18% [10], could end in a widespread destruction of employment. In this sense, the ERTE has provided, allowing the suspension of contracts and preventing their termination. This measure, which introduced flexibility, along with others such as the prohibition of layoffs given the risk-aversion mentioned above, has not, according to confidential business indexes, prevented the destruction of more than 950,000 jobs during the months of March and April [11].

Graph 6. Evolution of the unemployment rate (First quarter of 2018 to first quarter of 2020)

The ERTE as a defense for employment

As published in the Official State Gazette (BOE) [12], during the paralysis of economic activity and impending job destruction, the Government activated a contingency plan made up of tools that proposed flexibility in contracting regimes, including ERTEs. These represent a suspension — not termination— of contracts, and make unemployment invalid for three months after the conclusion of said agreement. This plan aims to recover much of the employment lost as a result of confinment, with state aid and once the pandemic is contained, preventing the unemployment rate from increasing above the high levels from before.

Thus, with the ERTE, and faced with the possibility of losing productive capacity, it was a matter of relaxing the situation for the network made up of almost entirely small and medium-sized companies (they constituted 99.88%) [13], with very limited cash flow (57 days) [14], and very low corporate liquidity in contrast to that of our counterparts in the community bloc (3% of total European liquidity) [15]. All of this seriously endangered the survival of jobs that, in the face of shock and confinement, became unsustainable for the employer. An unfeasible fixed cost burden in the face of a demand, paralysed by social distancing measures.

For this reason, the ERTE offers the possibility for businesses to suspend contracts, so that the company faces the expenses derived from Social Security, while, on the other hand, the State is in charge of providing the worker with a special unemployment benefit that, discounting unemployment, allows the suppressed income levels to be compensated. As published by the SEPE for the month of April, this motivated unemployment benefits to increase by 207.15%, while the demand for subsidies did so by 136.56% [16].

Thus, those companies affected by greater forces have applied for an ERTE to adapt to the new situation. As said mechanism is designed, this adjustment occurs through the suspension of the labour contract or by the reduction of working hours. This has relieved the employer of the fixed cost of unit labour per employee, in a scenario where absence of productive ability makes income impossible.

However, among the measures included in this BOE, the ERTE have also been subject to an extension of the contract for people who have left for a minimum period of six months. This condition induces severe risk aversion on the part of businessmen, as indicated in the aforementioned study that alludes to Okun’s law. On account of this many companies, instead of resorting to an ERTE, have proceeded to terminate their contracts, starting with the temporary ones — due to their lower cost — and ending with the indefinite ones. In this way, as SEPE itself collects during the month of April, the destruction of jobs amounted to more than 950,000.

This loss is of particular concern because it prevents the recovery certain positions, which will increase our structural unemployment. Apart from this, the ERTEs were invalidated as a definitive measure, meaning they had to act in conjunction with others which, due to the Government’s delay in approving them, resulted in implementation of the worst remedies by businessmen most concerned about the situation. Remedies that, like the prohibition to fire, ended up having a more negative effect on the economy, so that their application had to be reversed in order to relax the tense relationship between employers, the Government and unions.

The cost of the measures

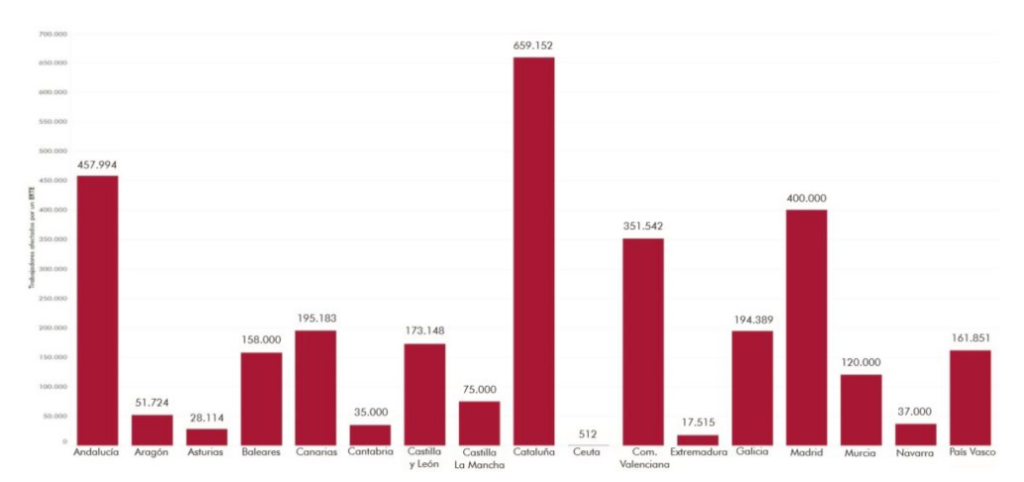

As collected by official data, the number of employees affected by an ERTE now stands at 3.4 million people [17]. This number, in contrast to the official number of unemployed — which does not include the ERTE because it has not exceeded three months — equals the country’s unemployment rate. Therefore, if the workers affected by ERTE were counted as unemployed, it would be more than 30%. However, given that the transition of people from ERTE to unemployment is not complete, the Bank of Spain maintains the number of unemployed at 22%.

Graph 7. Workers affected by an ERTE by Autonomous Communities

In this sense, for the time being the Government has excluded various aspects; more than 600,000 people affected by an ERTE remain unrecognized, an area which should be highlighted. If computed, unemployment might be around 35%, so in order not to unleash a collective hysteria in the business network and public opinion, they have decided that ERTEs should be left out of accounting.

If we take the average cost of unemployment benefits for an individual in Spain (852 euros) and apply it to the amount of unemployed in the country, taking into account the official registry, the result is an approximate cost of 3,450 million euros. If we project this amount until we reach the number of people affected by ERTE (4 million), which a large number of economists consider to be valid, then the cost could rise to 4,600 million euros. But, ultimately, since we must remember that many of the current unemployed who are now working will receive a higher benefit, thus increasing their average cost; especially in a scenario where, as published, there exists the possibility of receiving said benefit without reaching the minimum time. In that case, the amount could go up to more than 5,000 million euros.

Following this data, the cost of ERTEs would reach a relative value of approximately 0.3% of GDP. Curiously, this amount is similar to the expense projected by AIReF for the Minimum Vital Income (IMV) [18] that it wishes to apply. This charge is also reflected in the monthly expense of unemployment benefits, because, as we mentioned, we are facing an increase in this expense of 207.15%, and a 136.56% increase in applications. We do not refer to a single cost, but an additional cost due to the fact of 14% structural unemployment, with its high impact on public coffers.

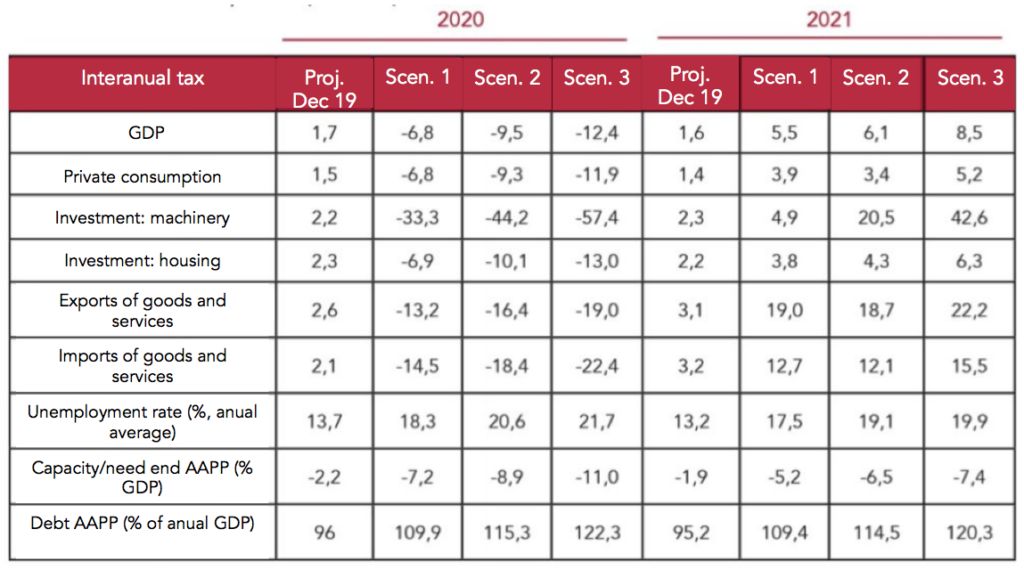

As indicated by the Bank of Spain and even AIReF itself, Spanish public debt, which already stood at 100% of GDP, plans to increase on account of the pandemic to 122% (See Table 1) [19]. Growth of over 22%, which again leaves the Spanish economy in a difficult situation for the coming years, as well as a very low fiscal buffer for new economic policies in a possible future recession. Nor can we forget our deficit level, which, according to the situation foreseen by the Bank of Spain, could exceed the 10% threshold [20], reaching over 11%. This deficit, in absolute terms, is equivalent to 130,000 million euros, although it would fall to 110,000 million when the effects of the pandemic, as well as the added expense that it implies, dissipate.

Table 1. Public debt forecast (% of GDP)

*According to the criteria used by EPA, workers affected by an ERTE and self-employed people not working now will be considered, in regards to the definition of the unemployment rate, as occupied (even though they are not in a strict sense from the point of view of contribution to the production while they are in this situation).

Conclusion

We must be aware of all the measures that are being implemented, as well as the costs involved. Debt and deficit are obligations of the State that it is transferring to the population: in a scenario of zero growth, today’s debt becomes tomorrow’s taxes. In a conjuncture in which the fiscal pressure will be increased by the new taxes (with increases in personal income tax, the Covid, Tobin and Google rates, as well as all the fiscal machinery prepared by the coalition of PSOE and Unidos Podemos), we exhibit caution. The freedom of the Spanish is at stake — not because of COVID-19, but because of the mortgage that the Government intends to leave for future generations.

[1] Instituto Nacional de Estadística (2020). Tasas de paro por distintos grupos de edad, sexo y comunidad autónoma. Retrieved from https://www.ine.es/jaxiT3/Tabla.htm?t=4247

[2] Eurostat

[3] Eurostat

[4] Instituto Nacional de Estadística (2020). Tasas de paro por distintos grupos de edad, sexo y comunidad autónoma. Retrieved from https://www.ine.es/jaxiT3/Tabla.htm?t=4247

[5] BBVA Research, (2012). Los efectos de la flexibilidad salarial sobre el crecimiento y el empleo. Madrid: BBVA Research. Retrieved from https://www.bbvaresearch.com/publicaciones/los-efectos-de-la-flexibilidad-salarial-sobre-el-crecimiento-y-el-empleo/

[7] Instituto Nacional de Estadística (2020). Tasas de paro por distintos grupos de edad, sexo y comunidad autónoma. Retrieved from https://www.ine.es/jaxiT3/Tabla.htm?t=4247

[8] Fondo Monetario Internacional (Octubre, 2019). Informe WEO: Perspectivas de la economía mundial. Washington D.C.: Fondo Monetario Internacional (FMI).

[9] García Solanes, J. (2019). La ley de Okun y las peculiaridades del mercado de trabajo español. Nada es Gratis. Retrieved from https://nadaesgratis.es/admin/la-ley-de-okun-y-las-peculiaridades-

del-mercado-de-trabajo-espanol

[10] Banco de España, (2020). Escenarios macroeconómicos de referencia para la economía española tras el COVID-19. Madrid: Banco de España, p 32.

[11] Cortés, R. (2020). España ha perdido 900.000 empleos desde el inicio del estado de alarma. Cinco Días. Retrieved from https://cincodias.elpais.com/cincodias/2020/04/02/econmia/1585808404_052531.html

[12] Real Decreto-ley 18/2020, de 12 de mayo, de medidas sociales en defensa del empleo.. Sec. I.

[13] Ministerio de Industria, Comercio y Turismo (2019). Retrato de la PYME. Madrid: DIRCE. Retrieved from http://www.ipyme.org/ Publicaciones/Retrato-PYME-DIRCE-1-enero-2019.pdf

[14] Coll Morales, F. (2020). Coronavirus: El tiempo juega en contra de las empresas que de media solo pueden sobrevivir 57 días sin ingresos en caja. Ok Diario. Retrieved from https://okdiario.com/economia/tiempo-juega-contra-empresas-media-solo-pueden-sobrevivir-57-dias-sin-ingresos-caja-5405877

[15] Abril, I. (2018). Las empresas españolas, a la cola de Europa por liquidez. Expansión. Retrieved from https://www.expansion.com/empresas/2018/07/29/5b5dea0446163f88a08b45d6.html

[16] Gómez, M. V.; De Barrón, I. (2020). El gasto en prestaciones se dispara hasta los 4.512 millones, un 207% más que en 2019. El País. Retrieved from https://elpais.com/economia/2020-05-05/el-gasto-en-prestaciones-se-dispara-hasta-los-4512-millones-un-207-mas-que-en-2019.html

[17] EpData (2020). Número de trabajadores afectados por un ERTE. Retrieved from https://www.epdata.es/numero-trabajdores-afectados-erte/3ffd669a-e2d2-4da6-9419-ec503bdf1bb0

[18] Roncella, L.; Roncella, A. (2020). ¿Ingreso mínimo vital para la crisis del coronavirus? Fundación Civismo. Retrieved from https://civismo.org/es/un-ingreso-minimo-vital-para-la-crisis-del-coronavirus/

[19] Banco de España, (2020). Escenarios macroeconómicos de referencia para la economía española tras el COVID-19. Madrid: Banco de España, p 32

[20] Banco de España, (2020). Escenarios macroeconómicos de referencia para la economía española tras el COVID-19. Madrid: Banco de España, p 32