Spain, the lowest income tax reduction for families

The ageing of the demographic pyramid has encouraged debate about the importance of approving public policies aimed at promoting birth. Taxes play an important role in this matter, since a higher tax burden results in a reduction in household disposable income, which complicates the financial sustainability of families.

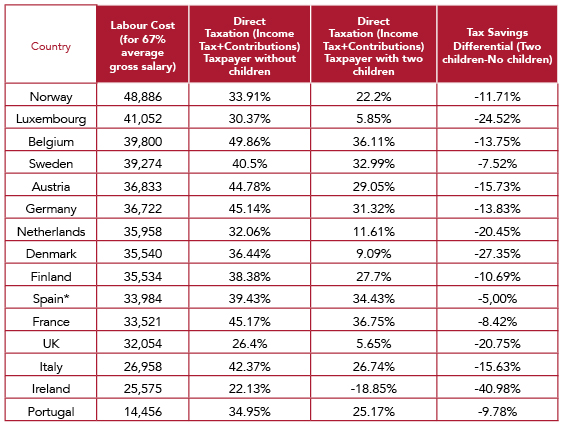

Unfortunately, Spanish taxpayers who have children bear a tax burden that easily exceeds the level of taxes in force in other countries of the European Union. In fact, if we analyze the situation of the fifteen wealthiest countries in our environment, we find that Spain is the country that least reduces taxes on families. Thus, although a taxpayer with an average salary and two children pays in Spain five percent less in direct taxation than a taxpayer who has no offspring, this reduction is well below the rest of the countries around us. We see it reflected in the following table:

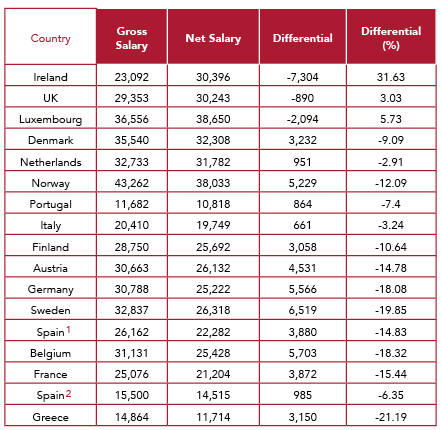

Table 1. Tax savings for taxpayers with two dependent children*

* Average salary in Spain. Calculations made for 2016, with an average national income tax rate.

The tax structure aimed at benefiting families is especially pronounced in the cases of Ireland (-40.98 percent), Denmark (-27.35 percent), Luxembourg (-24.52 percent), United Kingdom (-20.75 percent) and the Netherlands (-20.45 percent). There is also a reduction of more than 10 percent in the cases of Austria (-15.73 percent), Italy (-15.63 percent), Germany (-13.83 percent), Belgium (-13.75 percent), Norway (-11.71 percent) and Finland (-10.69 percent). Below are Portugal (-9.78 percent), France (-8.42 percent) and Sweden (-7.52 percent).

As a result, Spain is the European country that grants less tax advantages to families. The five percent reduction of direct taxation that supports a taxpayer with two children remain three times below the average of -16.4 percent observed in the fifteen countries analysed.

The third largest tax burden

But, apart from the different treatment between taxpayers without offspring and taxpayers with children, how much is the direct tax effort supported by taxpayers who have two dependent children? For the Spanish case, we speak of an effective rate of 34.43 percent, only surpassed by the French (36.75 percent) and the Belgian (36.11 percent). We speak, therefore, of the third largest tax burden of the fifteen European countries analysed.

Below the levels observed in Spain, we find Sweden (32.99 percent), Germany (31.32 percent), Austria (29.05 percent), Finland (27.70 percent), Italy (26.74 percent), Portugal (25.17 percent) or Norway (22.20 percent). A more favourable scenario to support the birth rate is found in the Netherlands (11.61%), Denmark (9.09%), Luxembourg (5.85%) and the United Kingdom (5.65%).

In the case of Ireland, effective taxation stands at -18.85 percent, so we speak of a negative tax. This means that not only direct taxes are not paid (in net terms), but also that tax transfers are received in the form of bonuses.

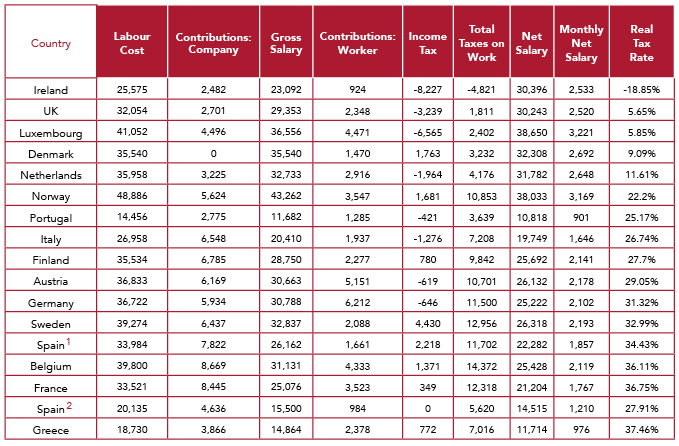

Single parents, also harmed

If we analyse the case of a single father or mother with two dependent children, we are also facing a similar situation. Spain is once again highlighted as a country of high taxes compared to the European average. For an average income of 26,162 euros, the real tax rate of direct taxation is 34.43 percent, only behind Belgium (36.11 percent), France (36.75 percent) and Greece (37.46 percent).

The tax treatment is more favourable in Sweden (32.99 percent), Germany (31.32 percent), Austria (29.05 percent), Finland (27.70 percent), Italy (26.74 percent), Portugal (25.17 percent) or Norway (22.20 percent). Even lower is the tax burden in the Netherlands (11.61 percent), Denmark (9.09 percent), Luxembourg (5.85 percent) and the United Kingdom (5.65 percent). Ireland appears, again, as the country that favours births the most. In this case we are again faced with a negative tax: the gross salary, of 23,092 euros is translated translates into a net remuneration of 30,396 euros once a real effective rate of -18.85 percent is applied.

Even if we go down to a scenario of less income, Spain does not do much better. Therefore, an income of 15,500 euros —the most common salary in our country— corresponding to a single parent with two dependent children faces an effective retention of 27.91 percent in direct taxation. This places us better than Austria, Germany, Sweden, Belgium, France or Greece… but worse than Finland, Italy, Portugal, Norway, the Netherlands, Denmark, Luxembourg, United Kingdom and Ireland.

Table 2. Direct taxation (IRPF + Social contributions) for a single person with two dependent children

* EU-15 countries. Single parent family with two children and compensation equivalent to 67 percent of the average gross salary of each country. Taxation in force in 2014. 1. Calculations made for 2016 for an average income of 26,162 euros; Personal Income Tax is calculated as the average of the Autonomous Communities, including Navarra and the Basque Country. 2. Calculations made for the year 2016 for the most common income in Spain of 15,500 euros; Personal Income Tax is calculated as the average of the Autonomous Communities, including Navarra and the Basque Country.

Negative taxes

The scheme of bonuses and deductions in force in Ireland converts a gross salary of 23,092 euros into a net salary of 30,396 euros, a turnaround of 7,304 euros in favour of the taxpayer. This negative tax scheme is also observed in the United Kingdom (890 euros) and Luxembourg (2,094 euros).

This scenario clashes with the situation we have in Spain, where a single person with two dependent children who receives a gross salary of 26,162 euros sees his income reduced to a net income level of 22,282 euros, a blow of 3,880 euros. For a lower salary of 15,500 euros gross, the net remains at 14,515, with the consequent decrease of 985 euros in disposable income.

Table 3. Work taxes for a single person with two dependent children

* EU-15 countries. Single parent family with two children and compensation equivalent to 67% of the average gross salary of each country. Taxation in force in 2014. 1. Calculations made for 2016 for an average income of 26,162 euros; Personal Income Tax is calculated as the average of the Autonomous Communities, including Navarra and the Basque Country. 2. Calculations made for the year 2016 for the most common income in Spain of 15,500 euros; Personal Income Tax is calculated as the average of the Autonomous Communities, including Navarra and the Basque Country.

¿En qué Comunidad Autónoma conviene tener hijos desde el punto de vista fiscal?

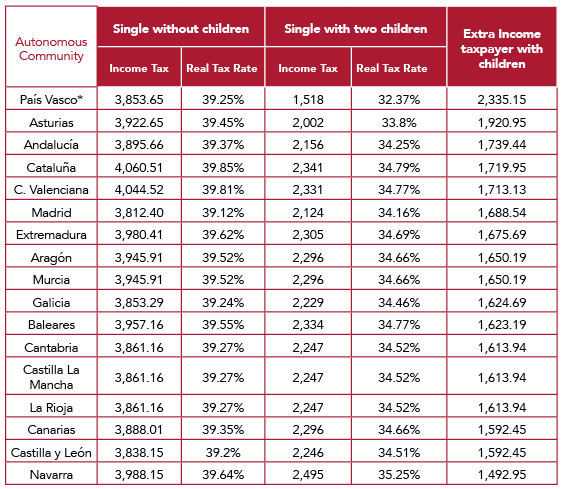

Nationally, children deduct in the personal income tax… but do so unequally depending on the autonomous community in which the taxpayer resides. There is a difference of up to 842 euros per year between what a person with dependent children in Navarra and the Basque Country pays. This comparison is not accidental: in Navarra it is the government which charges the most taxes to families with children, while that of the Basque Country is the one that gives them a better treatment.

If we consider the differences between the different autonomous communities, we find that a gross income of 26,162 euros with two dependent children can save up to 2,335 euros if the parent reside in the Basque Country. In the case of Navarra, the deductions would be limited to 1,493 euros. If we talk about tax rates, the direct taxation observed in the case of a taxpayer with two children ranges between 32.37 percent and 35.25 percent, while that same taxpayer would move between 39.25 percent and 39, 64 percent if the parent had no offspring.

Table 4. The treatment of children in personal income tax, according to Autonomous Community (Gross salary of 26,162 euros)

If one goes down to the detail of the different regional tax regimes, we see that the Balearic Islands and Madrid are applying a minimum per descendant higher than the state regulations in the case of the third and fourth children. They are the only autonomous communities that continue to make this different treatment, since Cantabria has eliminated it. On the other hand, in Asturias and Andalusia there are extra deductions for single-parent families, while in Madrid those taxpayers who have two or more children and do not reach a minimum level of income in their tax bases are rewarded.

Conclusions

Civismo defends a tax reform aimed at reducing the tax effort that Spanish taxpayers bear. In this regard, the comparison with Europe should encourage us to reflect on the advisability of approving significant reductions in direct taxes to increase the disposable income of households and contribute to the development of families.

Civismo also recommends the regional governments that their competencies should allow them to bet on differentiated policies that provide better taxation to taxpayers. In this sense, every effort to reduce regional taxes is welcome.