How long do you work for the state?

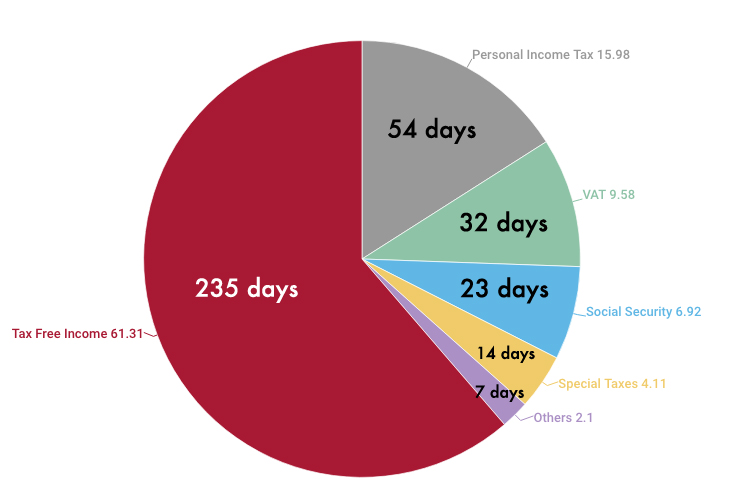

On May 10, it is Tax Freedom Day in Spain. In other words, Spanish workers need 130 days to fulfill their tax obligations. This is the date on which citizens would have generated enough income to pay all taxes. From then on it is when we start generating money for ourselves. The Tax Freedom Day translates tax pressure into the number of days workers need to pay their direct and indirect taxes, as well as Social Security contributions. A Spanish worker who earns the gross average salary (24,400 euros per year) would be spending 54 days to pay the income tax, 32 to pay VAT, 23 for the part of the Social Security that comes out of the employee’s gross salary, 14 for special taxes and 7 for other taxes. In total, any average employee spends 130 days of his work (or 8,667 euros) to fund public spending.

Tax Opacity

In addition, any employee’s company would pay as Social Security contributions an extra 29.9 percent of his gross salary (or 7,296 euros). This means that if the money paid by the company for each worker was included as part of the gross salary, the employee would receive an annual salary of 31,696 euros. If these contributions are added to the tax burden of the worker, the tax freedom day would be delayed until July 3.

The tax freedom day in Spain is is delayed 6 days in 2013

Tax increases implemented in the last year involve six more days of work for the average employee: 367 euros for the last VAT increase of September 2012 and 43 euros for the increase of municipal or regional taxes.

The last 3 years have brought us 750 more euros in taxes

The last tax increases would have cost eleven days of work in total and would cost 750 euros per employee: 125 euros attributable to income tax increases (state and regional), 192 euros that can be attributed to the increase in VAT in 2010 , 370 to the 2012 VAT increase, and 62 euros to other taxes such as IBI or special taxes, etc.

Graph 1. How do you pay your taxes

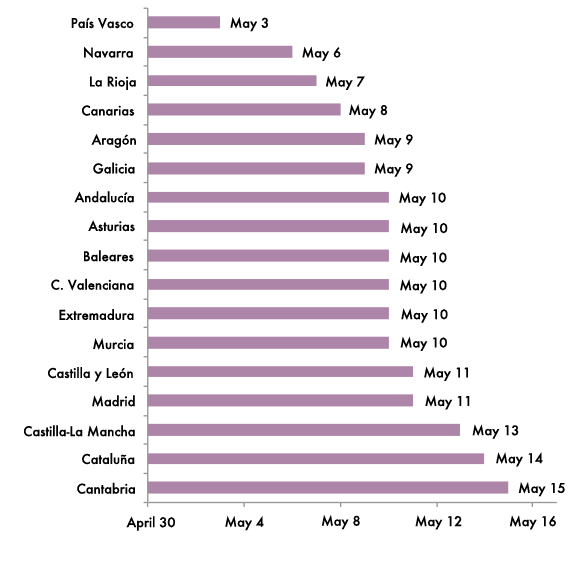

Tax Freedom Day by Autonomous Community

The latest increases in regional and municipal taxes are widening the tax differences between Autonomous Communities. Currently, there is a gap of up to 12 days between the Basque Country —the Autonomous Community with the lowest tax pressure— and Cantabria —the one with the highest fiscal pressure.

For an average Spaniard, living in Cantabria would take 12 more days of work per year and cost 782 euros extra than doing it in the Basque Country. This is because, in Cantabria, the Real Estate Tax is well above average. In addition, this community has chosen to apply the maximum autonomous surcharge allowed on the sale of fuels. This translates into 80 euros more that those living in Cantabria have to disburse annually to fill the tank of their cars. On the other hand, in the Basque Country, the tax freedom day arrives 7 days before the national average. This difference is exclusively due to income tax, so that the Basques save 442 euros in personal income tax, thanks to their regional regime.

In Navarra, as in the Basque Country, the tax freedom day arrives at the beginning of May, 4 days before the national average. In the case of Navarra, this difference is due both to income tax —in Navarra taxpayers pay 192 euros lower income tax than the national average—, as well as to a lower municipal tax burden through taxes such as IBI. Instead of taking the average salary of each region for the calculation, the national standard has been used in order to create a guide for the citizen: to which province it is more convenient to go to work all other things equal. This should also serve to stimulate tax competition among the Autonomous Communities, so that they offer a more favourable treatment to the taxpayer even in those taxes that have less ‘electoral cost’. One reason to calculate regional differences in equal pay is to avoid giving the impression that in the richest regions —where taxpayers pay more because they make more—, higher tax rates are charged. Thus, the comparison comes from equal conditions.

To calculate the tax freedom day in 2013, the same salary as in 2012 has been used to make the results comparable.

Graph 2. Tax Freedom Day by Autonomous Community

Singularities

Andalusia

Over the last year, tax rates have increased for average incomes whose net income exceeds 60,000 euros from 21.5 percent to 23.5 percent, and for incomes of more than 100,000 to 25.5 percent. Thus, the maximum tax rate applicable in Andalusia —the state section plus the regional one— reaches 56 percent.

It maintains the application of the sanitary cent for the sale of fuels at 2.4 cents per liter.

It recovers the real estate tax with tax rates ranging from 0.24 percent to 3.03 percent.

Aragón

It is one of the few Autonomous Communities that maintains the maximum rate of regional income tax at 21.5 percent, setting the maximum income tax rate at 52 percent.

It still does not apply the sanitary cent to the sale of fuels.

It recovers the real estate tax by applying the state rate whose tax rates range from 0.2 percent to 2.5 percent.

Asturias

There is an income tax increases for salaries that exceed 70,000 euros up to 22.5 percent, and another increase for those that exceed 90,000 up to 25 percent and half a point —up to 25.5 percent— for those with higher than 175,000 euros. Maximum tax rate: 56 percent. There is an increase in regional deductions for affected families.

It increases the tax on the retail sale of hydrocarbons to 4.8 cents per liter.

It recovers the real estate tax with tax rates of 0.22% to 3%.

Balearic Islands

It is one of the Autonomous Communities that maintains the maximum rate of regional income tax at 21.5 percent, so that the highest income tax is at 52 percent.

It also points to the sanitary cent by applying the maximum allowed rate: 4.8 cents per liter.

It recovers the wealth tax by applying tax rates ranging from 0.2 percent to 2.5 percent but slightly increasing the limits of the base compared to the state rate.

Valencian Community

It keeps unchanged the maximum rate of the regional income tax that is situated at 23.5 percent, so that the highest tax on income is 54 percent.

It continues to apply the sanitary cent with the maximum surcharge of 4.8 cents per liter.

It recovers the real estate tax by applying the state rate whose tax rates range from 0.2 percent to 2.5 percent.

Canary Islands

There is an increase in more than 1 percent the personal income tax for average salary whose net base exceeds 53,407 euros up to 22.58 percent. The maximum tax rate is 53.08 percent.

It recovers the real estate tax by applying the state rate whose tax rates range from 0.2 percent to 2.5 percent.

Cantabria

Nothing changes for the regional income tax. The regional rate stays at 24.5 percent, which translates into a maximum income tax rate of 55 percent.

It applies the sanitary cent with the maximum surcharge of 4.8 cents per liter.

It recovers the real estate tax by applying the state rate whose tax rates range from 0.2 percent to 2.5 percent.

Castilla-La Mancha

It is one of the Autonomous Communities that maintains the maximum rate of regional income tax at 21.5 percent, so that the highest tax rate is 52 percent.

It increases the application of the sanitary cent to a maximum of 4.8 cents per liter.

It recovers the real estate tax by applying the state rate whose tax rates range from 0.2 percent to 2.5 percent.

Castilla y Leon

It is one of the Autonomous Communities that maintains the maximum rate of regional income tax at 21.5 percent, so that the highest tax is at 52 percent.

It continues to apply the sanitary cent with the maximum surcharge of 4.8 cents per liter.

It recovers the real estate tax by applying the state rate whose tax rates range from 0.2 percent to 2.5 percent.

Catalonia

It maintains the tax rates on income, whose maximum level reaches 25.5 percent, so that the state and regional joint tax reaches 56 percent.

It applies the sanitary cent of 2.4 cents per liter.

It recovers the wealth tax with tax rates ranging from 0.21 percent to 2.75 percent. However, the minimum exempt amount in Catalonia is 500,000 euros, compared to 700,000 euros, which is usually the case for the remaining Autonomous Communities.

Extremadura

It maintains the tax rates on income, whose maximum level reaches 24.5 percent, so that the state and regional joint tax reaches 55 percent.

It also points to the sanitary cent by applying the maximum allowed rate: 4.8 cents per liter.

It recovers the real estate tax by applying a rate ranging from 0.3 percent to 3.75 percent.

Galicia

It is one of the Autonomous Communities that maintains the maximum rate of regional income tax at 21.5 percent, so that the joint regional and state tax reaches 52 percent.

It applies the sanitary cent up to a maximum of 2.4 cents per liter.

It recovers the real estate tax by applying the state rate whose tax rates range from 0.2 percent to 2.5 percent.

La Rioja

This Autonomous Community maintains the personal income tax between 11.6 percent and 21.4 percent, so that the total regional and state tax as a whole stands at 51.9 percent.

It still does not apply the sanitary cent to the sale of fuels.

It recovers the real estate tax by applying the state rate whose tax rates range from 0.2 percent to 2.5 percent.

Madrid

Madrid maintains the tax rates of personal income tax between 11.6 percent and 21.4 percent, setting the maximum income tax rate applicable at 51.9 percent.

It maintains the application of the sanitary cent to the sale of fuels but with the lowest surcharge of all the CCAA: 1.7 cents per liter.

It is the only autonomous community that maintains the 100 percent bonus on the real estate tax. Therefore, the people of Madrid are the only ones who are saved from paying this tax.

Murcia

It maintains the tax rates on income, whose maximum level reaches 23.5 percent, so that the state and regional joint tax reaches 54 percent.

It also applies the sanitary cent by setting the maximum allowed rate: 4.8 cents per liter.

It recovers the real estate tax by applying the state rate whose tax rates range from 0.2 percent to 2.5 percent.

Navarra

Navarra increases income tax rates for taxable bases that exceed 88,000 euros by 0.5 percent and by 3 percent for income of more than 300,000. The maximum tax rate reaches 52 percent.

It applies the sanitary cent of 2.4 cents per liter.

It recovers the real estate tax, with rates ranging from 0.2 percent to 2.5 percent. However, an exempt limit of 311,023 euros is applied, far below the 700,000 euros of other Autonomous Communities and with a normal housing exemption of 250,000 euros —also below the 300,000 euros threshold applied to the rest of the Autonomous Communities.

Basque Country

The Diputación de Guipúzcoa has deflated personal income tax rates so that people whose income has risen slightly do not go to a higher tax bracket. The maximum tax is 49 percent. Álava and Vizcaya have also deflated the personal income tax rate. The maximum tax rate is 45 percent.

All three increase personal and family minimums, benefiting the taxpayer. Instead, they limit contributions to private pension plans: 5,000 euros in Guipúzcoa and 6,000 euros in Álava and Vizcaya.

The Basque Country has chosen not to apply the sanitary cent to the sale of fuels.

Guipúzcoa recovers the wealth tax (Tax on Wealth and Great Fortunes) with tax rates ranging from 0.25 to 1 percent. But it taxes property and rights related to economic activities and participations in certain entities, hitherto exempt. The minimum exemption is 700,000 euros and 300,000 euros for regular housing. Álava and Vizcaya tax assets at rates ranging from 0.2 percent to 2 percent and 2.5 percent respectively and also improve the minimum exempt up to 800,000 euros and 400,000 euros for regular housing.

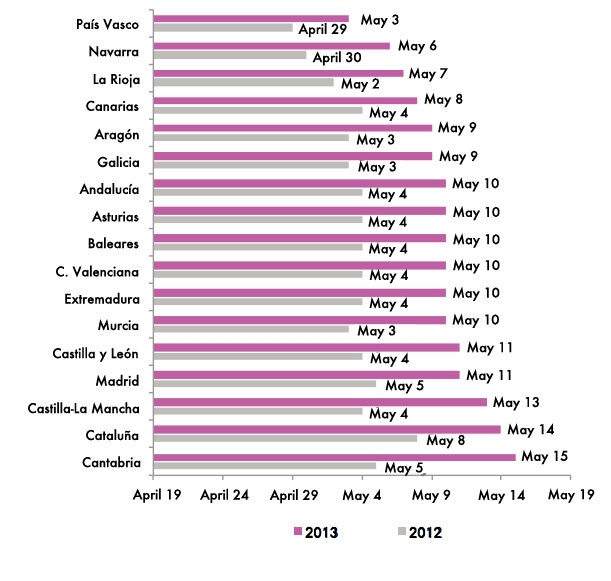

Evolution of the Tax Freedom Day 2012-2013

Over the last year, the Tax Freedom Day has been delayed between 4 and 10 days. The Basques have suffered tax increases the least, while the Cantabrians will have to work up to 10 more days in 2013 to pay taxes.

Apart from the VAT increase, the Cantabrians have been affected by the increase in the municipal property tax (IBI) in Santander, as well as by the application of the sanitary cent to the sale of fuels. Residents of Castilla-La Mancha also have to work 9 more days due to the VAT increase and for the application of the tax surcharge on the sale of fuels.

In Castilla-León and Murcia, 2013 brings 7 more days of work to pay the VAT increase, the fuel cost increase and the IBI increase. How then does the Basque Country achieve a rise in tax pressure of only 4 more days, under the 6-day national average? The answer is that, despite the crisis, the councils have chosen to deflate the income tax rates and have decided not to apply the optional regional fuel surcharge. Thus, they have managed to offset part of the latest VAT increase.

Graph 3. Evolution of the Tax Freedom Day 2012-2013

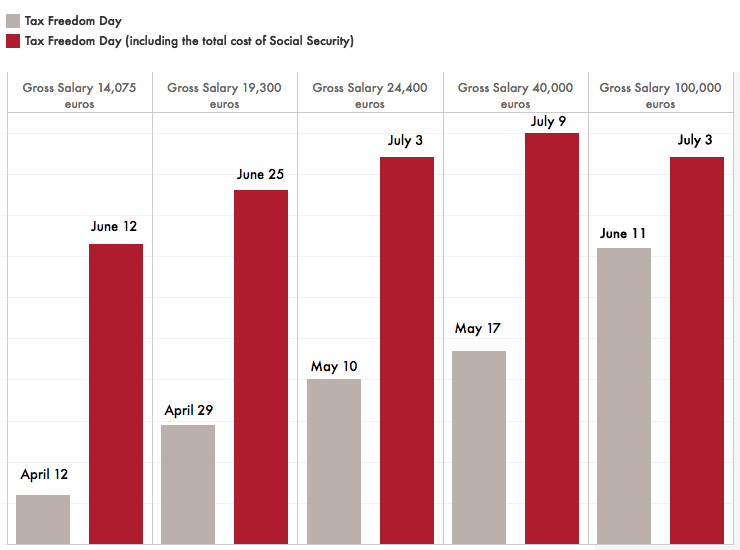

Tax burden and income

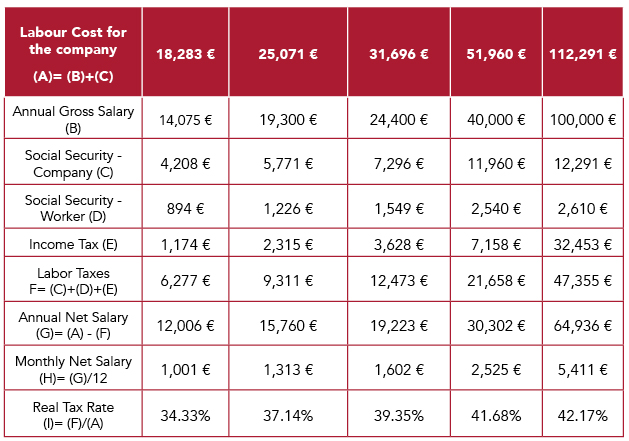

To analyse the tax effort based on income, five scenarios have been taken into account: (i) a person who earns 14,000 euros; (ii) another that earns 19,000; (iii) an average income of 24,400; (iv) a salary of 40,000; and (v) another of 100,000 with different personal situations and consumption habits.

As we can see in graph 4, the tax effort grows with the gross salary: from April 12 for an income of 14,000 euros to June 11 for an income of 100,000 euros; more than two months apart between someone that barely makes 1,000 euros a month and a well-off employee. However, if we add Social Security contributions paid by the company, the differences in tax effort between income are reduced to 27 days. Moreover, from a certain level of income, as Social Security contributions have a maximum limit, the tax effort of workers is reduced from July 9, in the case of a person who earns 40,000, to 3 July for a person with a gross salary of 100,000. The explanation of this behaviour is detailed in the next section that deals with labour taxation.

Graph 4. Tax Freedom Day by level of income

Taxation of labour

Salaries in Spain are three times taxed through income tax, Social Security contributions paid by the worker and those paid by the employer. Social Security contributions are in reality just another tax that the State tries to disguise or hide from the taxpayer as it does not appear in its entirety on the payroll.

As a result, it becomes a hidden part of our payroll. The contributions paid by the employer multiply by five times the withholdings that are made directly on the payroll of the average worker. However, as mentioned above, Social Security contributions can be considered an additional tax since, when contributing to a common fund from which the pensions of current retirees are paid, they do not represent real insurance for the current taxpayer. Social Security contributions, as it is well known, have a unique rate in Spain. This is not a progressive tax such as the personal income tax. In addition these contributions do not benefit from deductions based on the level of income. Therefore, even for the lowest income, the rate that is applied is the maximum rate of 36.25 percent. This is paid as follows: 29.9 percent is paid by the company and 6.35 percent by the employee. However, contributions have an income ceiling. Those that exceed 3,425.7 euros per month only pay up to this level; and the amoung beyond 3,000 euros is no longer subjected to Social Security.

Consequently, higher incomes benefit from this system. In turn, the existence of this ceiling poses another problem: for the employer it is certainly cheaper to raise the salary to the employees who earn more than to the lowest incomes, thus encouraging lower salaries and increasingly sharpening the possible differences between social classes.

To analyse the taxation of labour, the previous five assumptions have been taken into account: a person who earns 14,000 euros; another who earns 19,000; an average income of 24,400; a salary of 40,000 and one final income of 100,000 euros. For each of these cases, the corresponding income tax, the Social Security paid by the company and the Social Security paid by the employee have been calculated. The cost to the company or the total gross salary formed by the worker’s annual gross salary plus Social Security contributions paid by the company has also been calculated, as detailed in the table.

Once the total tax on labour, formed by the personal income tax added to the total Social Security contributions, has been calculated, the true tax rate applied to each of the five cases has been calculated.

Graph 5. Taxation of labour

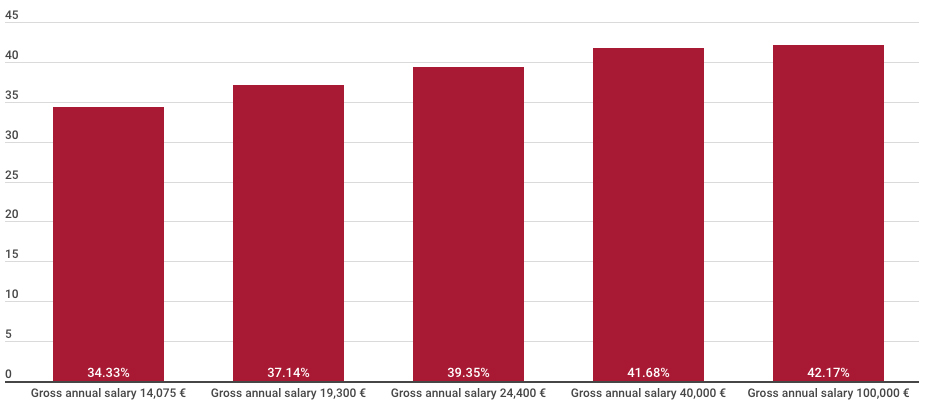

Progressiveness in Spain is less than 8 percent

The true tax rate for a someone making 1,000 euros a month is 34.33 percent; 39 percent for a net salary of 1,600 euros; and 42 percent for one of 5,400 euros. These results reveal that the progressiveness in labour taxation is reduced to only eight percent. Thus, it is of little use that there are Autonomous Communities like Navarra that have up to eleven tranches of income or that the tax rates range from 13 percent (Navarra) to 56 percent in some Autonomous Communities since, in the end, this difference of 43 percent is reduced to a real difference of 8 percent.

For this same reason, different OECD studies, including Taxing Wages, reveal that beyond a certain level of income the system is regressive. That is, comparatively, low and medium incomes pay considerably more taxes than high incomes.

Graph 6. Real tax rate according to income level

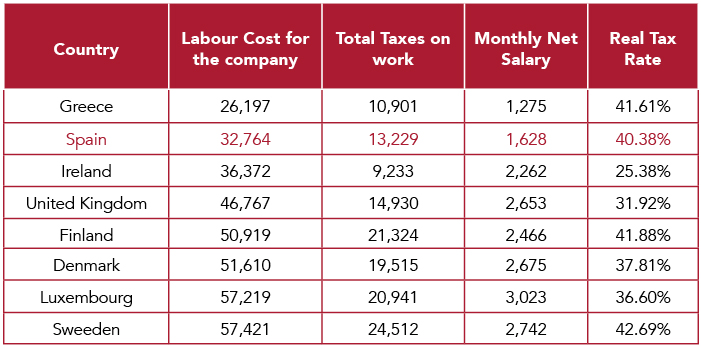

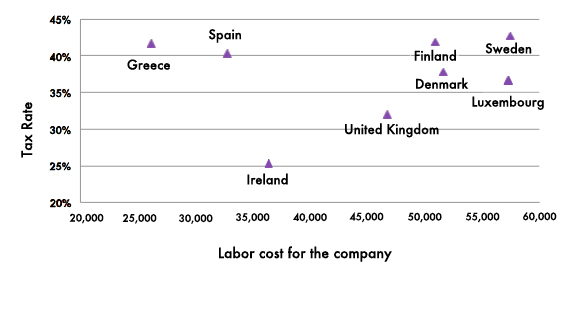

If we analyse the situation of the average Spanish worker in a comparative perspective within other EU member states, we observe how the tax rate applied here (40.38 percent) on an average net income of 1,600 euros, is similar to that applied in countries like Sweden or Finland. However, a crucial difference should be noted: the average salary of these countries, which is reflected in the table, almost doubles the income of a Spanish worker.

Graph 7. Taxation of labour in the European Union

However, we also have the example of Greece, which with a lower income level than ours, has a tax rate of 41.6 percent. On the other hand, countries such as Ireland or the United Kingdom with higher average income levels than Spain, tax income at much lower tax rates than ours: 25.38 percent and 32 percent respectively.

Once again, Spanish taxation is evidenced by taxing average and low incomes well above what would be necessary. But high incomes are not saved from high taxation either. According to the latest Taxation Trends in the European Union report, Spain is one of the countries of the European Union in which the maximum income tax rate is the highest (56 percent), at the same level as Denmark (55.6 percent) and only surpassed by Sweden (56.6 percent). The maximum personal income tax rate applicable at this time in Spain is 56 percent, although not all Autonomous Communities have chosen to raise it to this level. In the rest of the world, according to a 2012 KPMG report, only Aruba (59 percent) has a maximum income tax rate higher than that of Sweden.

Graph 8. Real tax rate

Taxation in the OECD

In 2012, according to the OECD report Taxing Wages, the tax pressure on the average income in Spain was six points higher than that of other member countries, ranking 12th. Over the last year, Spain has been the country that has increased the most its tax burden on income: by 1.42 percent, ahead of Poland (1.19 percent) and Slovakia (0.8 percent). The study also analyses the tax pressure that couples with children endure in each of the countries based on the level of income. According to this study, after the latest increases in tax rates in Spain, couples with children and a single salary withstand a tax pressure well above the OECD average (9.3 percent) and Germany (1.2 percent).

In the last three years, this type of taxpayers has been the most punished group for the tax increase in our country. In the case of a single-parent family with children and an income that does not reach 70 percent of the average salary, the tax pressure doubles the average of other developed countries: 29.9 percent versus 16.8 percent (OECD average), continuing the trend of recent years.

Principles of a good tax system

Albert Einstein said that the most difficult thing to understand in the world is the income tax. This is not surprising if we take into account the way in which tax systems are designed in some countries. Already in the eighteenth century, Adam Smith traced the general principles for a good tax system in The Wealth of Nations. First, proportionality: each person should pay a proportional percentage (not progressive) of their income, complying with tax equity. In addition, taxes should be predictable; that is, not arbitrarily set, avoiding the exemptions and deductions established according to the source of income or other factors.

The system should not create incentives to avoid taxes (see the ‘Depardieu case’) and it has to be simple to minimise the cost of collection. According to the Paying Taxes 2013 report, in Spain, a company dedicates 167 hours a year to pay taxes: approximately one month of work to comply with tax requirements. The study reveals that reducing the complexity of the tax system would raise GDP, on average, 0.5 percent. Switzerland and Luxembourg are the European countries where fewer hours are spent to pay taxes: 59 and 63 hours respectively. That is, three times less than in Spain. A good system is also characterised by tax pressure that does not discourage work and investment. In addition, it should not encourage certain groups to try to obtain tax benefits from the hand of the rulers.

The US-based Tax Foundation also establishes a guide on the characteristics that any tax should meet: It is all about transparency, neutrality and simplicity.

Social Security contributions paid by the employer which do not appear on the worker’s payroll are the best example of tax opacity. The income tax in Spain, with 11 income tranches, has tax rates that range from 13 percent to 56 percent, plus regional and state deductions, which make this tax the antonym of tax simplicity. Stability is another important characteristic to respect, which means that tax policy should be consistent and maintained in the long term. In addition, changes cannot be retroactive as has been the case in the application of the real estate tax.

In fact, taxpayers have to be confident, rely on the legislation in force when they sign a contract or make a transaction. The tax system should have broad tax bases, so that the tax rates can be moderated (see VAT) and, finally, the system should not restrict free trade. If a single tax rate for VAT were applied in Spain, it could be well below the current 21 percent and would also help to eradicate tax fraud.

Summary and conclusions

The tax burden borne by taxpayers in Spain varies depending on the level of income, consumption habits, and the Autonomous Community in which they reside. Therefore, although Spaniards work, on average, until May 10 to pay all their taxes and until July 3 if social security contributions paid by the company are included, this average date hides important differences from one Autonomous Community to another. Or from one level of income to another.

For the calculation of the Tax Freedom Day, instead of taking the average salary of each region, we have used a national standard in order to create a guide for the taxpayer: to which province it is convenient to go to for a taxpayer in the hypothetical case that a company would offer him the same salary? If we only look at the percentage of taxes paid in each territory, it would seem that those who have higher incomes are also those who have higher taxes. But this is a false premise.

At the same level of income, with similar personal circumstances and consumption habits, differences from one Autonomous Community to another can represent up to 12 work days. These are mainly due to the Property Tax, a municipal tax, which varies greatly from one municipality to another. The same goes for another municipal tax: the circulation tax that is higher in cities such as San Sebastián, Santander, Valladolid or Palma de Mallorca. To a lesser extent, income tax also influences the tax burden. Navarra and the Basque Country are the two communities that have taken advantage of their tax regime to tax income below the national average. Other communities, such as Madrid or La Rioja, for example, have also used their regional tranche of the income tax to reduce the tax rate to different income levels. On the other hand, Catalonia, Andalusia and Asturias have used the regional tax to punish higher incomes. The autonomous communities have also applied different family minimums or regional deductions that benefit single-parent families with several dependent children and also large families.

Another example of a tax that the Autonomous Communities have used and which has also translated into differences in the tax burden, is the so-called ‘sanitary cent’. Aragon, La Rioja and the Basque Country are the three Communities that have distanced themselves most from the others by not applying this regional surcharge to the sale of fuels. The report also analyzes the tax freedom day for different income levels. The results reveal that there is more than two months of difference between a 1,000 euros-a-month and a well-off worker. However, if social security contributions paid by the company are added, the differences in tax effort between incomes are reduced to 27 days. Moreover, once a certain income threshold has been exceeded, the tax effort is reduced, first by the issue of social security contributions and secondly due to the consumption tax.

The consumption tax, VAT, is a tax that although it has different reduced types, it makes the tax effort of the lowest incomes that devote all their income to consumption greater than the tax effort of the well-off families since they the latter can dedicate part of their income to savings, and therefore that part does not pay VAT.

The analysis of the tax effort carried out by the taxpayers of the different Communities, reveals that these have sufficient tax tools to modify the tax burden borne by the taxpayers, either through autonomous communities’ or municipal taxes. This way, tax competition would be encouraged and it could be analysed whether a lower/higher level of tax effort can be used to reactivate the economy and especially employment.

However, in recent years, at the juncture of the economic crisis, many Autonomous Communities have used their ability to regulate certain taxes to increase fiscal pressure. It should not be forgotten that Autonomous Communities such as Navarra or the Basque Country, which historically have had a tax pressure on income below the Spanish average, have also enjoyed lower unemployment rates. When analysing labor taxation, it has been seen that the average Spanish income is taxed at the same level as in Sweden or Finland despite the fact that these countries double the level of income and that the wealthiest families pay taxes on income at the highest tax rate in the world, only behind Aruba and Sweden.

We have also observed how 60 percent of taxes on income are hidden and do not appear on the payroll of the worker. This are mainly the Social Security contributions paid by the company; money that involves a significant expense and that influences the worker’s salary. In addition, it is these same contributions, which have a unique rate and a maximum cap that make progressiveness be reduced from 43 percent —as stipulated in the personal income tax— to a real differential of only 8 points.

Thus, the more complex the tax system is, the less it serves to achieve the objective for which it has been designed. Therefore, the tax reform must begin by including the employer’s Social Security contributions in the gross salary and merging them with the worker’s contributions to reflect the real tax burden. In that case, the taxpayer would be working longer to pay their taxes than for himself. And the Tax Freedom Day would then become July 3.

Methodology

The Tax Freedom Day translates the tax pressure into the number of days that taxpayers need to cover their tax obligations. It is the date of the year in which a person has generated enough income to pay all their taxes. From then on, taxpayers stop working for the State and starts earning money for themselves.

Tax Freedom Day takes into account the income tax, Social Security contributions by the worker and direct and indirect taxes: VAT, Real Estate Tax, special taxes (on alcohol, tobacco, electricity, hydrocarbons …), circulation tax, retail sales tax of certain hydrocarbons, the Property Transfer Tax (ITP) and Documented Legal Acts (AJD), etc.

To calculate the income tax, the different regional tables, the reductions for work income, the personal and family minimums and the different regional deductions of the full quota by large family have all been taken into account. For the calculation of the IBI, three types of dwellings located in the capitals of the autonomous communities have been used. The assignment to each user (who has home ownership) of one of the three types of housing is made based on the level of their annual gross income.

In case of not having data for the capital city or another important city of a given Autonomous Community, the national average is used instead. For the Circulation Tax a car of between 12 and 16 horses has been considered. For motorcycles, an average quota has been calculated for both those with less than 500CC and those with more than 500CC. Since the circulation tax is a municipal tax for each community, the tax applied to the capital of the region has been taken into consideration. In the case of beer, one of 330 ml has been used as a unit, with a volumetric alcoholic strength greater than 2.8% vol. and a dish grade lower than 11.

With respect to the alcohol tax, a glass of 20g of pure alcohol has been taken as a standard unit. For the tobacco tax, the average sale price of cigarettes has been used instead of the maximum retail price for each brand. To calculate this average, the statistics of the Commissioner for the Tobacco Market of the Ministry of Economy and Finance have been used.

In the tax on hydrocarbons, a distinction is made between gasoline and diesel. The average sale price in Spain has been taken. The regional type has also been taken into account.

For VAT, the costs that impact VAT are calculated first. The VAT supported is calculated differently according to the level of income, based on the distribution of household expenditure by expenditure groups and tax rate.

To determine the tax freedom day in each Autonomous Community, a married person has been considered, with a child in charge of the two parents and with a gross income of 24,400 euros. The taxpayer manages to save 1,000 euros a year, has property and car housing, so 200 euros are spent on gas per month. Also, smoke half a pack of cigarettes and drink 7 beers and two drinks a week. Monthly electricity bills reach 50 euros. The arithmetic average of what a taxpayer who earns 24,400 euros (the average salary in Spain) in the above mentioned situation would pay in each of the autonomous communities has been calculated to determine the tax release day for Spain. As for the results, the Tax Freedom Day has been calculated considering only the Social Security contributions by the worker. However, once the contribution to Social Security has been introduced by the company, the tax freedom day is significantly delayed until the middle of the year.

References

European Commission (2013), “Taxation trends in the European Union”, Eurostat Statistical Books

James Rogers & Cécile Philippe (2013) “The Tax Burden of Typical Workers in the EU 27”, New Direction

KPMG International (2012). “KPMG’s Individual Income Tax and Social Security Rate Survey 2012”

OECD (2012), “Taxing Wages 2011”, OECD Publishing. Paturot, D., K. Mellbye and B. Brys (2013), “Average Personal Income Tax Rate and Tax Wedge Progression in OECD Countries”, OECD Taxation Working Papers, No. 15, OECD Publishing.

PWC (2013), Paying Taxes 2013

Torres, C., K. Mellbye and B. Brys (2012), “Trends in Personal Income Tax and Employee Social Security Contribution Schedules”, OECD Taxation Working Papers, No. 12, OECD Publishing.