Introduction

When an economy begins to exhibit chronic deficit, the first question society asks is what the Government does with all the capital and tax revenues that the country receives. Statistics show that this capital reached an all-time high last year, but nevertheless, as seen in the previous weeks, Spain increased its deficit again up to 2.8%, as concluded by Brussels [1]. Hence, exceeding the 2% promised by the Prime Minister [2]. This means raising more money has not managed to reduce the enormous hole of public spending in the country, which has been criticised on countless occasions, but for which no feasible solutions have been proposed.

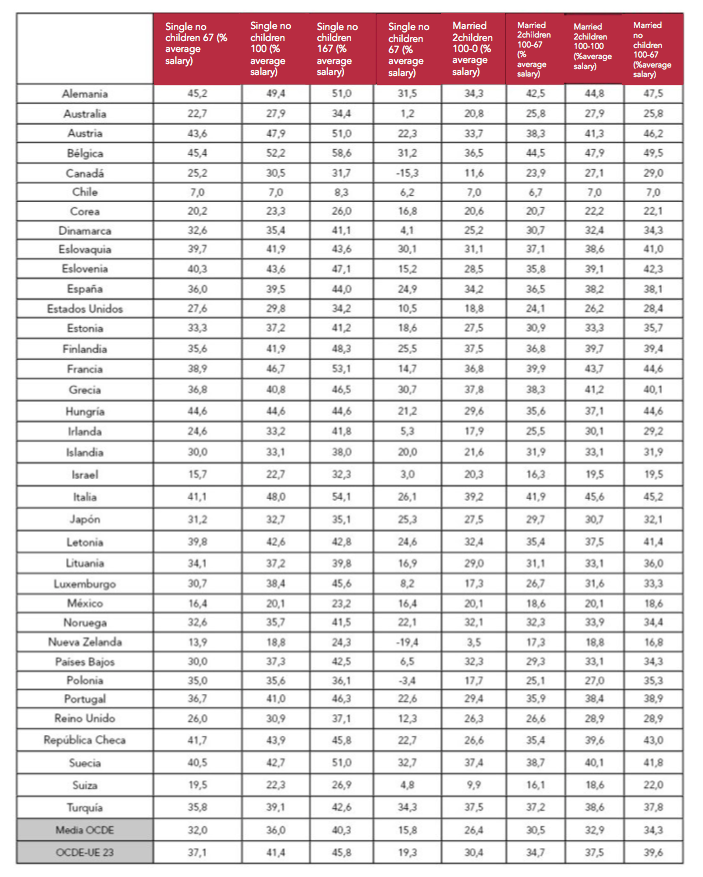

Thus, a series of propositions have been brought to the table to the table to address this chronic deficit. The rescue of the savings banks and elimination of all political spending have been the most serious proposals and, for the moment, have gained greater traction with Congress’ audience. Finding effective solutions is essential to reduce the public spending that not keeps us in debt, but also suffocated in the tax atmosphere. As reflected in the OECD [3], the Spanish tax wedge amounts to 39.4%, in contrast to that of the rest of the member countries whose average is 36.1%.

Table 1. Income tax plus contributions from employer and employee minus cash loans (as % of labor costs, by type of households and level of salary)

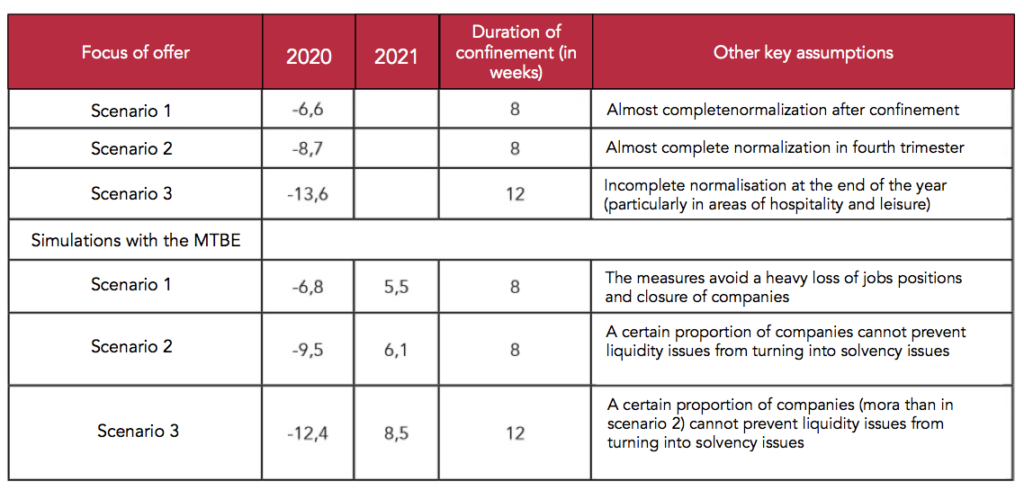

Afirmaciones como “la deuda de hoy son los impuestos del mañana” se cumplen en el caso de España. En los últimos 20 años, hemos pasado de una deuda casi inexistente a que esta se acerque al 100% en relación al PIB [4]. Las previsiones que realiza el Banco de España (BdE) para la coyuntura post COVID-19 la sitúan alrededor del 122% (Tabla 2) [5]. Un proceso acumulativo que, sumado a un entorno de bajos crecimientos, acompañará a la economía española hasta que se corrija un sistema que, como reflejan las cuentas públicas, se muestra plenamente deficitario.

Table 2. Assumptions in three scenarios

In recent years, there has been much talk of correcting the deficit through the elimination of a number of headings, alleviating the situation progressively through taxation. However, despite this proposal’s popularity among public opinion, if these measures played out they would be useless, taking years to correct the deficit if at all. We refer to headings such as political spending, the Royal Household, and new income such as the COVID Rate, and the Tobin and Google rates. Taking into account a deficit that AIReF [6] estimates at 110,000 million euros, eliminating expenses such as that incurred by the Royal House – an average of 8 million euros – would result in 0.007% of the deficit that Spain has, and only in the current year.

Another example: the rescue of savings banks. If we put the bailout at 60,000 million euros, though this is not the actual level, and account for the tax that the Government intends to apply to banks to gradually recover the capital paid out by the State, the estimated tax revenue would increase by a total of 1,200 million euros. In this sense, as with the Royal House, we are talking about an amount equivalent to 1% of Spain’s public deficit. Even so, we can continue to analysing these headings, in order to evaluate what expenses our country should eliminate to eradicate the entire chronic deficit that it has.

One of the promises that the United Podemos party made during its campaign was based on the authorisation of new sections in the income tax (IRPF), in order to increase revenue at the cost of higher incomes. This tax reform, as proposed by the political party, would entail an additional income of 328 million euros: an amount equivalent to 0.3% of the annual public deficit that Spain will have after 2021. This also occurs with the COVID rate, another tax to be implemented which, according to the estimates of Unidas Podemos, would reach an aggregate revenue of 11,000 million euros. In this case, we are talking about 10% of the annual deficit that Spain would have as of the following year. However, bearing in mind that this forecast could be overestimated, the negative externalities of taxing large fortunes should be considered, which would entail capital flight or tax evasion.

For example, some companies such as SICAVs have a series of advantages that pervert revenue collection. Eliminating them could yield between 300 and 350 million euros (0.30% of the deficit). For its part, the Tobin rate would generate 850 million (0.77% of the deficit hole). Finally, suppressing the entire state (with all the associated bureaucracy, the country’s public employees, policy expenditure) would be equivalent to 30,000 million euros more in revenue. Only 30% of the existing deficit.

Thus, after evaluating each proposal as a unit, if we compute everything exposed in terms of new taxes and cuts proposed by the political parties, aggregate revenue could amount to about 42% of the country’s total annual public deficit. In other words, even with utopian cuts, which are impossible to implement in practice, the Spanish economy would not regain the budgetary discipline necessary to lower the level of debt and pay the tax that, since Brussels, Spain must comply by being a member of the community bloc as specified by the Stability and Growth Pacts (PEC).

Subsidies: the invisible spending of the Spanish economy

After analysing the situation in the country, we faced difficulties in obtaining data on subsidies in Spain, as well as transparent indicators on the matter. Some portals collect this information, as does the BOE, but not with sufficient rigor; this point will be addressed in the conclusions.

Among the data obtained, we can highlight the increasing cost of subsidies in Spain. This expense accumulates year after year, as it lacks the processes necessary for it to be evaluated. The «Limited State» portal [7] contains a chart that shows the evolution experienced by subsidies since 1995, when their amount did not reach 4,000 million euros.

As reflected in the calculations made by Fundación Civismo, this expense has increased by approximately 210%. In other words, Spain has tripled its amount in the last 25 years. As shown below, this amount exceeds 14,000 million euros, distributed in multiple headings collected by the Government, but which is not analysed over time, given that it lacks monitoring teams.

Despite the fact that the General Subsidies Law (LGS) has a competitive evaluation process, many of the subsidies are processed by direct concession. The regulation in this matter, according to a study by Antonio Bueno from the University of Córdoba [8], is conditioned by the decentralisation of competence in autonomies, which invalidates the measures taken to counter inconsistency, such as the proposals by LGS itself.

The aforementioned paper state: “The basic legislator was very strict when establishing the assumptions in the LGS that public administrations can resort to the procedure of direct granting of subsidies, limiting them, in practice, to three cases. This legislative option was not accidental, but rather the response to a previous situation in which the administration exercised broad discretionary powers for the establishment and granting of subsidies, which did not always guarantee full accordance with the principles of publicity, equality, and objectivity or efficiency in the use and allocation of public resources. The new legal regime was an undoubted advance, but its analysis reveals gaps, contradictions and shortcomings that require amendment.

Now, from the joint study of our entire system, it appears that the main cracks in the legal regime of direct granting of subsidies are not found in the LGS, but in the autonomous subsidy regulations, where they have been given an admirable, though censurable, creativity. It is undoubtedly this area that reform efforts should focus on.”

This inefficient system owes itself to the transfer of certain powers to autonomous communities that, through their regulation, invalidate the plant. Direct concession provides a legal loophole in the application process for qualifying for subsidies, which causes greater difficulty in measuring the objectives, as well as greater associated public spending. Therefore, financial aid is granted without subjection to an evaluation of the spending, or to a series of requirements that, through competent implementation, would prevent them from being approved.

More studies reflect a major problem that needs to be corrected. Spain exhibits a hole in public spending, which is caused by capital allocation to subsidies that yield little return. Therefore, given the volume they occupy in our public accounts and the increase they have experienced, we should avoid this expense, which could be invested in evaluating the opportunity cost. Until the these costs can be effectively measured, cuts cannot be implemented in areas that require greater austerity. In other words, this is a substantial expense that, until further improvements, we will not be able to avoid.

Many economists and politicians, after evaluating the which items would benefit from cuts [9], have agreed that subsidies are one of them, especially in situations of exorbitant public spending and public accounts that exhibit a deficit structure. For this reason, it is urgent to study and control such budget headings that, if not reduced through cuts, will be charged to pensions and public wages, with possible negative externalities on other variables such as consumption, savings or, as a consequence of this, the investment.

Our study, as subsequently endorsed by another by the AIReF that we will detail, gathers a panorama in which public funds destined for subsidies present a series of irregularities that the Minister of Social Inclusion and Social Security himself recognises. As president of the Independent Authority, he already highlighted this situation, which, if left unaddressed, will continue to expand.

For example, we have observed duplication in these grants. They are presented to countless entities and institutions which receive generous amounts to carry it out the same goal. In the absence of an evaluation or expressed justification of the expenditure of the subsidy, duplication continues perpetually. On the other hand, it is impossible to measure the degree of achievement of the objectives that, a priori, have acted as triggers for executing these subsidy lines.

Throughout the year, as the Transparency Portal of the Government of Spain reflects, our country grants more than 14,000 million euros in subsidies. This expense, in contrast to other headings, is equivalent to 1% of GDP and could increase the deficit that the Bank of Spain anticipates after the pandemic by 10%. However, the problem does not lie in the economic endowment of these items, but, as reflected in the AIReF study «Spending Review» [10], in the evaluation that should be conducted by the State which is currently nonexistent.

One of the main objectives of awarding grants is to promote and improve a series of issues that, driven by these state aids, achieve better performance. However, innumerable foundations receive aid on an annual basis, by economic endowment that does not hold the foundation accountable for use, and which is subsequently lost in oblivion.

This dynamic persisted even in the midst of a pandemic, despite the fact that Spain’s financial situation is in serious danger. With a budget of 1,000 million euros for medical equipment, our country has been granting fourteen times greater that amount to a series of headings including aid to an association that sponsors golf, a hockey club, and prizes held by the Córdoba Provincial Council [11]. Despite contractual obligation with said institutions, the obligation to guarantee the health of the security and forces of the State should prevail. Public officials who, together with the health workers, have found themselves without resources to protect themselves against the harmful effects of COVID-19.

The capacity to increase the rigor of subsidy grant applications exists through the implementation of control mechanisms that try to convert them into investments, which would be more productive for the country and its economy. In addition, the work of evaluating subsidy programs is evaluated along with the associated cost that it entails which, according to AIReF, is useless in measuring the impact that this injection of resources will incur. This is creating a hole in public spending which does not provide grounds for drawing precise conclusions, and generates the need to continuously increase revenue. All of this works to cover a deficit system that integrates a series of superfluous expenses which, despite fitting into the aforementioned dogmas, do not come up in debate due to the citizens’ own ignorance.

As previously mentioned, and as detailed by the aforementioned AIReF study, there are several aspects to highlight in the field of subsidies. One is the fact that has been no record of the implementation of strategic programs to evaluate subsidies (PES) until 2017. That is, until then, public administrations did not have mechanisms that the LGS requires. Only four ministries complied with the regulations on evaluation and monitoring when awarding grants.

Despite the improvement that these strategic programs provide, they still exhibit deficiencies that render them of no value in application and decision-making: these PES include existing subsidy lines, but not the information about their impacts, nor on the control and monitoring of said monetary deliveries for the different purposes for which they were granted.

It is also necessary to develop a homogeneous and regulated plan for the presentation of PES, since their heterogeneity in the different autonomies makes them difficult to evaluate at the central government level. The General Intervention of the State Administration (IGAE) had planned to apply such homogeneity, but the plan is still pending approval. At the moment, the Autonomous Communities are in charge of issuing their own PES to evaluate the subsidies. In addition to being heterogeneous, the PES continue to have shortcomings, such as the fact that they do not link subsidies to strategic objectives that pursue autonomy. Therefore, a proposal for strategic objectives is presented, but it does not address to which specific objective each grant corresponds.

Nor can any information be extracted from the indicators that, for the moment, contain the PES. These collect the degree of execution of the subsidies granted, the applicants for them, and their census data. But they do not measure other items of great relevance such as the degree of achievement of the objectives, the each one’s cost, or the line of subsidy itself.

The most serious part is that the PES of the autonomous communities, in many cases, are not published because they do not meet the criteria and requirements. This reflects an enormous lack of transparency, since citizens are being vetoed from accessing information on the expenditure that has been incurred. This is added to the lack of bodies in charge of evaluating the execution of these subsidies and measuring the degree of achievement of the objectives set. AIReF also highlights this situation: in the absence of a supervising body, PES are forgotten in transparency portals and, subsequently, are only supervised by restless citizens who seek certain data for studies and publications.

Therefore, these expenses, taking into account the financial situation of Spain, should be redirected immediately, within the structural reforms that the country must undertake. In a scenario of chronic deficit that tries to alleviate debt through unfruitful headings, it perpetuates others without even evaluating if they can be maintained. It is useless to allocate public money without control, if, subsequently, we do not monitor it to assess the effect of these grants on the real economy.

Draft reforms to recover the economy

The little discipline that the Spanish economy exhibits in terms of public spending, and the lack of committed management, is a very serious error. A clear reflection of this lies in the subsidies that, as the AIReF study shows, do not pursue a specific goal; at least, as shown by the PES trying to analyse the performance of these costs.

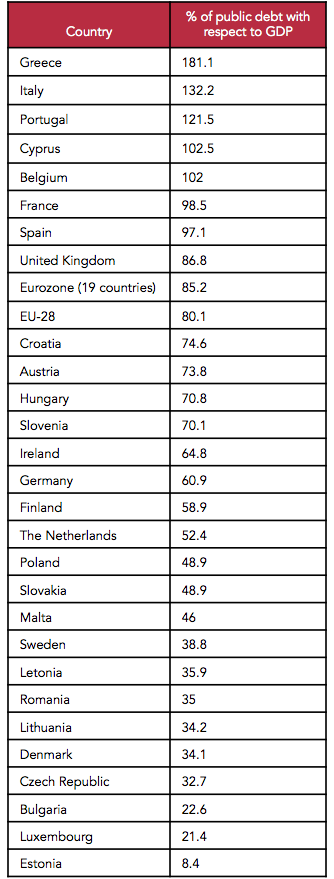

In this sense, what a priori constitutes an investment, Spain has turned into a cost. We are talking about concessions that, in individual headings, can reach up to half a million euros and which, observed in detail, reveal superfluous spending. In the face of such deficit levels, Spain should suspend these with more zeal. This pandemic has exposed a very worrisome scarce fiscal cushion in Spain, and a consequent lack of working capital to make important decisions. As an example of this, the injections that Germany or the Netherlands have made in the economy, compared to those that Spain has made [12]. Without backing for its 183,000 million euros, the injection of our Government is comparable to that made by the German or the Dutch. Their high surplus, as opposed to the chronic Spanish deficit, allows these countries, which were described as unsupportive, to apply a stimulus to save their economy, as well as providing aid to other nations that need to be rescued, as in the case of Spain.

Table 3. Public debt of the Member States of the European Union (EU-28) in the fourth quarter of 2018 in relation to GDP

For this reason, it is necessary to follow recommendations, including the transfer of supervisory powers to independent authorities that evaluate and track public spending; a budget cleaning, with a consequent adjustment plan; the audit of public spending on a permanent basis, with indicators of public access; improvement of the transparency portals offered by the Government to follow up on said expenses; connecting budget headings and subsidies to the objectives set by the State and autonomies; full homogeneity in the presentation of the PES and in the reports on public spending; and finally, plans to progressively reduce debt levels.

Lastly, but also of great importance, it is necessary to emphasise the role that decentralisation of competences in subsidies plays through direct concession, which invalidates a LGS that tries to limit said spending. Therefore, the LGS should be strengthened, so that this competence corresponds to an independent body, which would be in charge of evaluating the lines of subsidies as well as the objectives they pursue.

With proposals such as those mentioned in the previous paragraphs, the Spanish economy would not only be better managed, but could also begin to allocate a larger amount to repaying of a debt that, in the face of new recessive environments, could put us in grave danger. Tracking public spending would allow us to redirect capital, which for the time being is dedicated to unknown causes, towards profitable investments that would generate productivity for our economy.

It is time for Spain to start taking action on this issue, applying the proposed measures and setting up an independent decision-making team. Transparency and management are key in this matter. For this reason, it is necessary to leave the purely political policies under the management of the public budget, establishing a clear separation of powers that guarantees compliance with the obligations and commitments of the State. Non-compliance leads us to scenarios in which, as with debt, we spend more than 30,000 million euros in interest [13] over one year. This debt that only knows how to widen, under a public administration that continues to gaining popular votes by granting funds and the increasing of the weight of the State, at the cost of the consequent reduction of liberties.

[1] EP, (2020, 22 de abril). España cerró 2019 con un déficit del 2,8%, el segundo mayor de la eurozona. Expansión. Retrieved from https://www.expansion.com/economia/2020/04/22/5ea01944468aeb7e058b4573.html

[2] EP, (2019, 11 de septiembre). Sánchez dice que el déficit está «controlado» en el 2% y que España crecerá «sin problemas» un 2,2%. Europa Press. Retrieved from https://www.europapress.es/economia/macroeconomia-00338/noticia-sanchez-ve-controlado-deficit-pib-cree-crecimiento-llegara-problemas-22-20190911130019.html

[3] Oecd.org, (2018). Los trabajadores en los países de la OCDE pagan una cuarta parte de sus salarios en impuestos. Retrieved from https://www.oecd.org/centrodemexico/medios/lostrabajadoresenlospaisesdelaocdepaganunacuartapartedesussalariosenimpuestos.htm

[4] Epdata.es, (2020). España – Deuda pública en España hoy, según datos del Banco De España. Retrieved from https://www.epdata.es/datos/deuda-publica-espana-hoy-datos-banco-espana/7/espana/106

[5] Banco de España, (2020). Escenarios macroeconómicos de referencia para la economía española tras el COVID-19. Madrid: Banco de España, p.32.

[6] AIReF, (2020). La Airef estima un déficit del 10,9% del PIB en 2020, pero no descarta que llegue al 13,8% en un escenario más adverso. Retrieved from https://www.airef.es/es/noticias/la-airef-estima-un-deficit-del-109-del-pib-en-2020-pero-no-descarta-que-llegue-al-138-en-un-escenario-mas-adverso/

[7] Cabrera, I., (2018). Subvenciones por tipo – Estado limitado. Estado Limitado. Disponible en http://www.estadolimitado.com/subvenciones-por-tipo/

[8] Bueno Armijo, A. (2017). La concesión directa de subvenciones. Revista de Administración Pública, 204, 269-312. doi: https://doi.org/10.18042/cepc/rap.204.10

[9] Castillo, E., (2020). Siete partidas presupuestarias donde España gasta mal. Cinco Días. Retrieved from https://cincodias.elpais.com/cincodias/2019/07/05/economia/1562345518_632738.html

[10] AIReF, (2020). Plan de acción de la revisión del gasto en subvenciones del conjunto de las Administraciones Públicas. Spending Review. Madrid: Autoridad Independiente de Responsabilidad Fiscal (AIReF). Retrieved from https://www.airef.es/wp-content/uploads/2018/08/AIReF-Plan-de-Acción-Spending-Review-Aprobado-por-ACM-.pdf

[11] Infosubvenciones.es, (2020). Base de datos nacional de subvenciones. Retrieved from https://www.infosubvenciones.es/bdnstrans/GE/es/index

[12] EFE, (2020, 9 de mayo). Alemania y Francia triplican las ayudas a la liquidez de empresas otorgadas por España. Expansión. Retrieved from https://www.expansion.com/economia/2020/05/09/5eb66c54e5fdea40128b461e.html

[13] Calvo, P. (2019, 15 de enero). La factura de los intereses de la deuda pública se enquista en los 30.000 millones. El Español. Retrieved from https://www.elespanol.com/invertia/economia/20190115/factura-intereses-deuda-publica-enquista-millones/368714791_0.html