INTRODUCTION

Once the essential problem of family savings in Spain has been recognised in the first report of this series, we will outline strategies that are part of a savings promotion plan that takes into account the basic and daily needs of the family and that adapts to the objectives that each one has. Undoubtedly, in order to better prepare ourselves for the challenge of longevity, it is necessary to save more and continuously over time. This behaviour should begin as soon as possible and the volume of savings should grow as our salary income does. Thus, depending on the risk profile of each person, the management of savings will be different: some will prefer to save on lower risk assets, others more risky; some with more liquidity and others with less liquidity.

But, in any case, the most important thing is to save more. It is not something of rich people or professionals with high salaries. It is about assessing which expenses are essential and which are not and, from there, decide each month how much you want to save. They do not have to be large amounts, since in this time of salaries generally, it would not be possible. But from the age of majority, with small amounts you can get significant savings over 40-50 years. Saving 50 euros a month, being very conservative, would provide almost 10,000 euros in 10 years.

Therefore, the first step to increase our savings in a sustained way is undoubtedly tidying up family finances. Specifically, this means keeping the family budget as a summary of income, expenses and savings and, on the other hand, the balance or summary of assets and liabilities, both real and financial.

THE LACRA OF EXCESSIVE DEBT

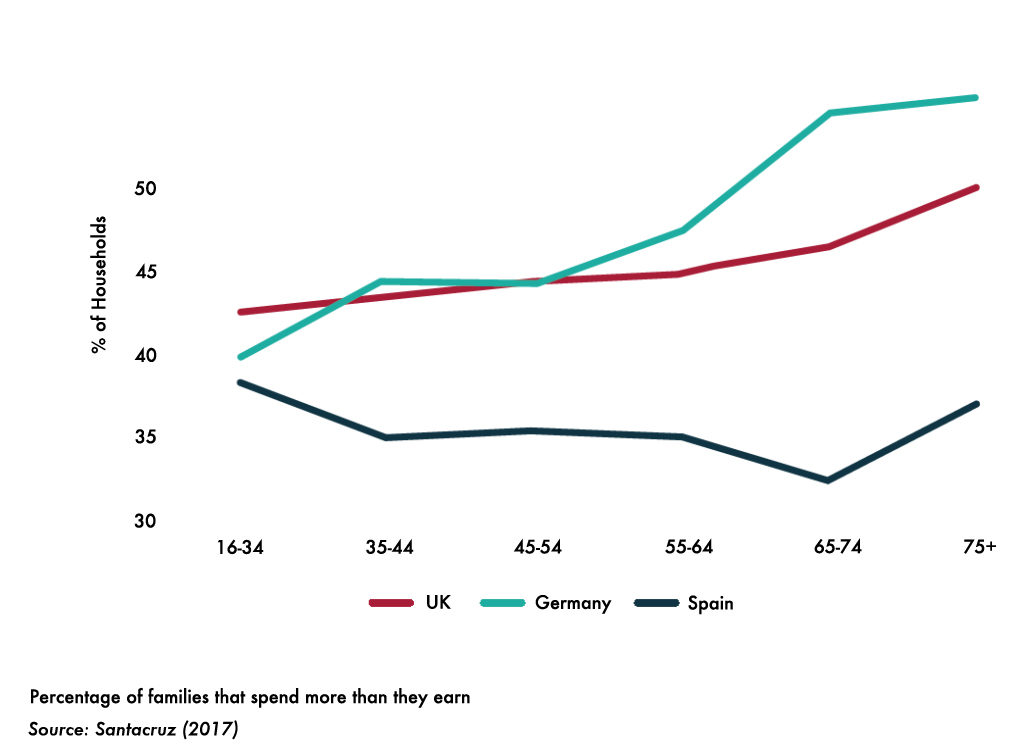

In the long term, the key is not to spend more than what is entered; and if one has to borrow, do it with a financial back, for example, the one that supposes a buffer of savings. It is not good that 63 percent of Spanish families spend more than they enter throughout their life cycle and, therefore, have to be borrowing frequently. This excessive dependence on credit (which requires paying high interest bills, commissions and financial expenses) ends up eroding people’s quality of life and progress. Debt helps to boost economic activity as long as the effort that has to be made to pay it does not exceed what we are capable of producing.

This dependence on credit can go to extremes such as having a debt on monthly income in the youngest cohorts of 270 percent because of having contracted a mortgage loan. In this sense, before optimizing indebtedness, we must review what the family budget consists of, what reforms must be carried out in terms of income and expenses, and what strategies to use to increase the level of savings.

THE FAMILY BUDGET: ORDER IN INCOME AND EXPENSES

The first step is to order personal finances. It is essential that the whole family unit be involved and that all members participate in the decisions, even if only one person (the head of the family, for example) is responsible for implementing the decisions made. That all family members participate reinforces the decisions made, holds them all accountable, and provides the motivational force to control and achieve the objectives set.

(i) The degree of economic stability of a family is determined by the quantitative control of income and expenses.

(ii) This control allows individualizing corrective actions that may offer greater stability, and even improve the family’s economic situation.

Controlling the family budget allows:

(i) Know and understand the structure of the income and expenses of a family.

(ii) Distinguish and analyse in detail the items that make up the family income statement.

(iii) Optimise the management of inputs and outputs.

(iv) Maximise savings.

What advantages does good family budget management offer?

(i) It allows anticipating or delaying expenses.

(ii) Save for contingencies or emergencies.

(iii) Inform the other family members what is spent and hold them accountable for what affects them.

(iv) Evidence of attention points if there are problems.

(v) Reduce stress and increase safety.

(vi) Increase the economic strength of the family.

Specifically, the first thing to do is to order the daily income and expenses. The main objective of this measure is to block the “waterways” that the family budget has each month in the form of expendable expenses that do not provide additional well-being and (more importantly in an environment where salaries are not very high) stop consumption behaviours that harm more than benefit.

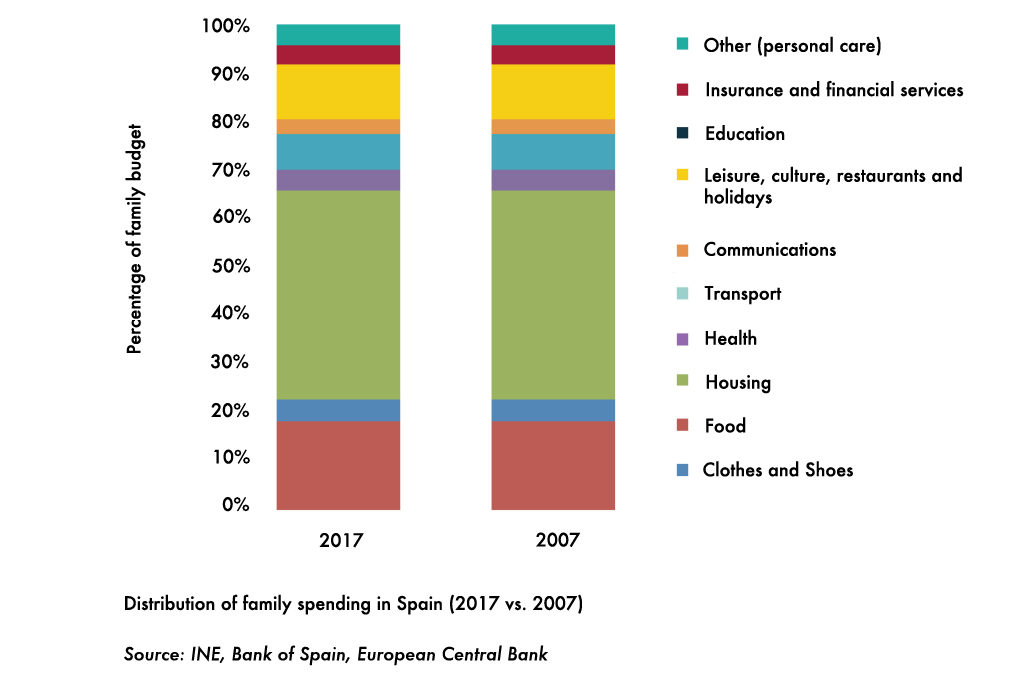

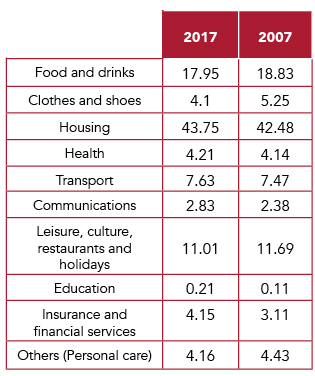

What does it mean to order expenses? Simply, separate those that are essential from those that are not, prioritise, for example, the basic expenses of food, clothing, transportation, communications and basic consumption for housing. It is necessary to take into account that the housing —with mortgage or for rent— is dedicated between 30 percent and 40 percent of the family budget, which makes this expense the principal of any Spanish family and, without a doubt, one of which presents greater margin for efficiency.

Here it is important to understand the concept of “imputed rent,” a cost that is not visible to the homeowner but is a good indicator of the real cost of a home owned, as it measures the effort involved in maintaining it (contributions, taxes , inflation, community expenses …).

Home ownership has a sustained cost throughout time that must be taken into account when making rental or purchase decisions or, for example, asking for a mortgage. In statistical terms, it reflects the estimated price that a person who owns a home would be paying if instead of owning it he lived on rent.

This effort for housing grows as age increases and disposable income decreases, especially when it goes from active life to retirement. Entering less money per month should meet the same level of household spending or higher, since the price of supplies (water, electricity, gas) only grows. Therefore, the elderly make an extra effort that makes them more vulnerable to unforeseen expenses or in situations where with their pension they have to help unemployed relatives who are experiencing economic difficulties.

Table 1. Distribution of family expenditure as a percentage of the monthly family budget

Optimising current spending on housing is very necessary because it is not always a good idea to have a home owned. The real estate market and technology are offering attractive solutions for the society of the future. There will be cases in which having a home on property comes out better than being for rent and others in which the formulas that are used today for tourist housing are more suitable. It is not known what the home of the future will be, but what is clear is that buying a house will not be a top priority as it has always been in Spain.

Secondly, at the same time that efficiency in current expenses must be increased, and especially in energy savings, those expendable expenses that, considered individually, may appear of little importance, but whose monthly sum must be reduced as it is large. For example, hiring insurance policies above what is necessary, excessive recourse to purchase on credit, improvisation in the management of vacations and trips away from home, etc.

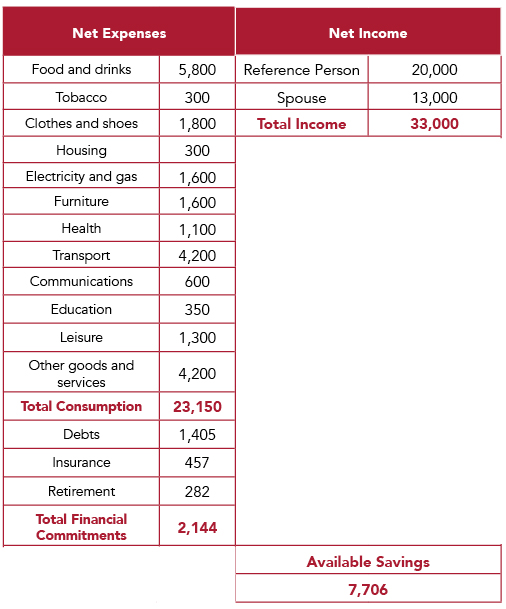

Thirdly, once income and expenses are sorted, the next step is the creation of a “mattress”, usually called an “emergency fund”, that serves as a reserve box for when an unforeseen and unavoidable expense occurs. . This is the first and most immediate application of the basic principle «pay yourself first», which allows us to set a savings amount from which to plan the consumption of the rest.

Finally, a good mechanism to carry out the first steps in terms of saving is to incorporate “automatisms” such as the following:

(i) Have an account for income and consumption, and another account (or a monetary fund) with automatic transfer at the beginning of the month for savings.

(ii) Contribute automatically to investment funds or pension plans each month.

In short, avoid having to be overly aware of savings, which eliminates stress. With these automatic mechanisms and a family budget such as the one offered below, a family will already have the necessary tools to face the last step in the optimisation process that consists of taking stock of assets and liabilities. To this we will dedicate the next report.

Table 2. Scorecard example of a family budget

CONCLUSION

To conclude, the first step in the strategy begins by ordering expenses and income through simple and direct mechanisms that combine the will and effort of the person to improve their level of well-being and that of their family. Especially, the order chosen matters: first the expenses and then the income, contrary to what is commonly thought. We must not forget that in a non-small part of the Spanish population, the only way of optimisation is on the expense side: the two tails of the demographic distribution, on the one hand the young and, on the other, the retirees whose income only they depend on the public pension and with a limited saving capacity a priori.

Savings must always be prior to retirement, so that, once retired, we have enough money to meet all our needs. During retirement it is advisable to have financial assets that generate a monthly income high enough to maintain all expenses and provide us with a comfortable standard of living, for example, a life annuity or a reverse mortgage in the case of owning a home.