Introduction

In this report Civismo, in collaboration with Value School, reviews what «security» and “investment” truly mean, strategies that a saver can employ to use these two powerful tools to achieve their life goals, and what consequences they might have on financial health.

Security

«Security» means the search for protection against a range of unforeseen events, usually extreme situations that impede the development of the saver’s life, such as death, severe disability, illness or accident. To meet suchdemands, which arise spontaneously in human life, «insurance» was created as an instrument that protects the beneficiary against the unforeseen event of the contract.

But a person’s life or vital elements are not the only assets worth protection, if not also their heritage, wealth. In both cases, risk that can be estimated under an uncertainty formula, yielding the maximum expected loss in the event of the contingency to be mitigated.

Over time, insurance techniques have become remarkably sophisticated, becoming one of the most advanced fields of applied mathematics. Undoubtedly, the profession of insurance companies has contributed to a solid and sustained market of high complexity which has nevertheless managed to penetrate the entire society.

What are the main contingencies over which people demand security? According to the average of recent demographic studies in several European countries, fear of a lasting illness that leaves the person in a situation of disability or dependency is the first of the risks considered. In second place is the inability to face the medical expenses derived from long or intense disease treatment and, lastly, the lack of solvency in old age.

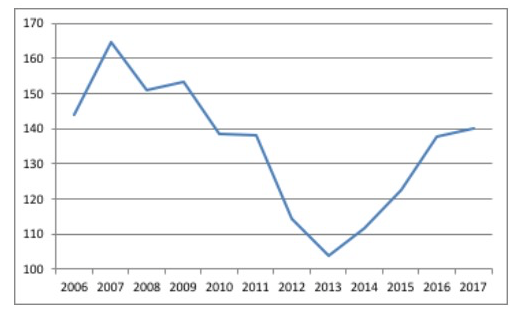

In this situation, how should the risk be faced and most importantly, what alternatives exist to build a consistent and effective security compatible with the rest of one’svital objectives? For some people, gambling is an answer to dealing with unforeseen events. The following graph shows the evolution of family spending dedicated to games of chance (lotteries, betting, casinos or gambling houses) in annual terms:

Graph 1. Spending per household in games of chance

Spending on games of chance behaves pro-cyclically and ahead of the pace of the Spanish economy. Spanish families spent €165 on average at the peak of the 2007 bubble, while the following years it reduced by 40%. Since then, it has risen again, reaching between €140 and €150 according to the latest Family Budget Survey.

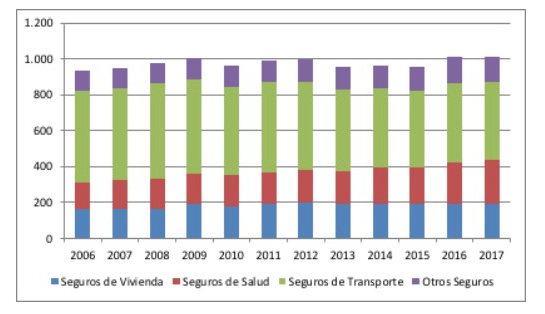

This attitude towards risk is a minority, although public opinion does view it as a problem in some age groups. In general, citizens face risk through the insurance market in both the Life and Non-Life branches. The annual budget allocated to this exceeds €1,000, as detailed in the following graph:

Graph 2. Household expenditure on insurance (2017)

Although Spain is a country with an insurance tradition, the majority of insurance spending is spent on compulsory insurance such as vehicle transport. This is followed by health insurance, which is very relevant in Spain. Despite having a universal state health system, Spaniards continue to demand health insurance to cope with illnesses and contingencies that occur throughout their working life, although from retirement the majority turn to public health. In this sense, the state health system constitutes coverage against «tail risks» such as the inability to meet the medical expenses caused by a long illness or chronic pathologies.

Finally, within the Non-Life branch, home insurance is increasing its weight in the family budget, while other types of insurance remain stable; among the latter, death insurance is the most common.

With an understanding of the common insurance package of a Spanish family, we will now focus on what parameters enclose insurance contracts and what elements of evaluation should be used to review its coverage over time.

Five questions summarize the study:

a) Person or object of protection: individual or collective (family)

b) Through which dimension the unforeseen event is insured (income, assets, some tangible asset or fact…)

c) Against what risk is security being sought: three fundamental risks deserve a special chapter: a. Death, b. Disability, c. Long (chronic) disease

d) For how long

e) With what economic value

Through these categories, the degree of security required can be determined. First, with respect to the person or object requiring security, the head of the family is normally thought of as the ultimate objective of protection. However, depending on the family situation, it may be more important to protect the family from an unforeseen event that causes one of its non-productive (non-income generating) members to fall into a situation of disability or dependency that causes a large consumption of resources over time.

This does not invalidate the protection of the head of the family, especially in the event of premature death. In this case, there is a double dimension to protect: on the one hand, the consumption of the whole family, but also, on the other hand, the generation of income with which to maintain family well-being.

Secondly, regarding what to protect against risk, it is necessary to prioritise those things that cause significant consumption of resources over time. Thus, a main mortgage, a life pension or having children at home for longer than usual are elements which require one to seek sufficient income or wealth security.

Thirdly, with respect to which risk security is sought, three categories stand out: death, disability and long illness. In the event of death, most claims arise when the main source of income dies before having covered essential objectives such as the education of the children, their financial independence or the payment of the mortgage. In the case of disability, the death problem —especially if it involves the disappearance of the main source of income— is compounded by a flow of unexpected expenses caused by this situation. Finally, a long illness incompatible with the generation of income is an extreme risk for to which to seek coverage, even though in Spain there is a universal health system.

Fourthly, the duration of the security is determined based on the time it would most likely take for a person to replace their main source of income and, therefore, to provide an “economic cushion” for the family. For example, for a debt such as a mortgage, the security period is the residual term of repayment of the credit. This is substantial in the increasingly frequent circumstance of a single person. For a single person, and even more so if they are a self-employed professional, protection should last the entire horizon of their life.

Finally, fifthly, the economic value of protection is calculated from the economic need remaining in the family. For example, if family consumption is protected in the case of the death of one of its members, the amount to be insured is the total annual family expenditure minus the consumption of the deceased family member. But if the case is one of permanent disability, it is necessary to ensure the current annual expenditure of the family plus the dependency expenses of the sick member, which can be, on average, above €16,000 per year.

Dependency is the «tail risk» that is becoming increasingly common and with increasingly higher costs. In particular, the search for private measures for personal care requires a growing budget that the public health system does not cover. Some source of income usually contributes toward this, such as non-contributory pensions or invalidity pensions, although the amounts are small compared to the market price of care.

In this sense, the capacity of the Welfare State to offer security to people is diminishing as a result of the inverted population pyramid; it is still capable of generating minimum incomes, but not enough to fully ensure the economic well-being of the family.

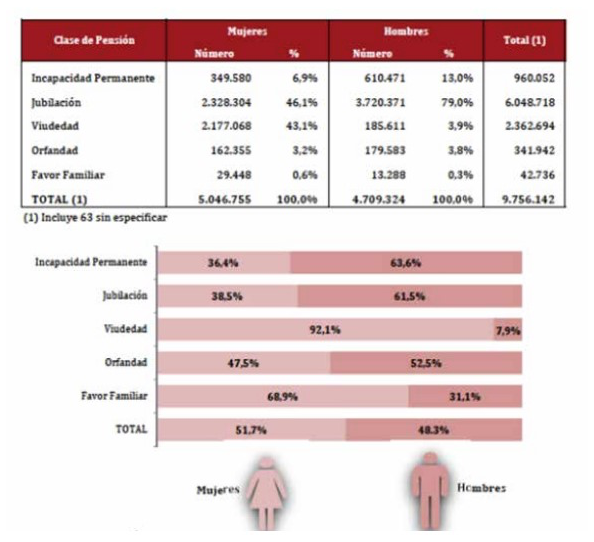

Graph 3. Number of current Social Security benefits

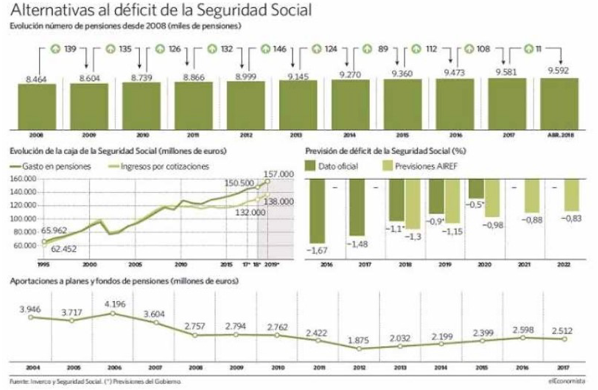

The critical situation of public resources can be observed in the following graph, which shows Social Security’s financial weakness and the expectation that public benefits in relation to the average salary will be cut in the medium term.

Graph 4. Financial situation of the Social Security system

In regards to the above, it is necessary to consider private coverage such as life insurance. For this type of insurance, the insurer is obliged under contract to satisfy the beneficiary with capital, income or other agreed benefits in the event of death, or survival, or both together.

The most notable instruments available are:

a) Temporary life insurance

b) Whole life insurance; before analysing the specificity of each insurance it is necessary to remember the basic concepts of insurance

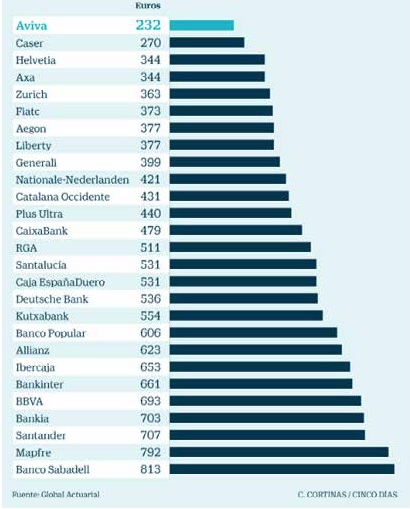

Life insurance in its different modalities enjoys an extraordinary situation in the Spanish market, as reflected in the last ICEA reports on premiums paid and benefits in 2019. But, above all, it reflects a situation of competition between insurance entities, which increasingly optimal for this type of instrument.

Graph 5. Evolution of life-risk premiums

Classification of insurance prices of life-savings. Average cost of a bonus that guarantees a capital of 120,000 euros

Investment

The evolution from being a saver to an investor is the last dimension to achieving long-term financial stability. First of all, investment must be seen as a means, never an end. It is not necessary to condition the vital objectives to the results that can be obtained from an investment — quite the opposite. In the end, investing is simply about allocating savings to two types of basic instruments: real assets or financial assets.

The investment meets three needs:

a) Security

b) Aspirations

c) Potentiality

To achieve security, as seen in the previous section of this study, insurance, liquidity and reserve instruments are used. For the «aspirational» need, resources achieve a higher level of future income that meets life goals. Finally, in the case of potentiality, a clear attitude of risk, including speculation, allows the desired resources to be reached faster and in more abundance.

Based on these needs, an investment plan is built that allows a person to determine how many resources they need and where they will obtain them. To build this plan, one must first intersect income, expenses and available and planned savings. If these alone do not achieve the vital objectives (home purchase, retirement capital or children’s education), one must consider where to place the savings.

Second, it is necessary to determine the level of risk, which can occur in three degrees:

a) Conservative

b) Moderate

c) Risky

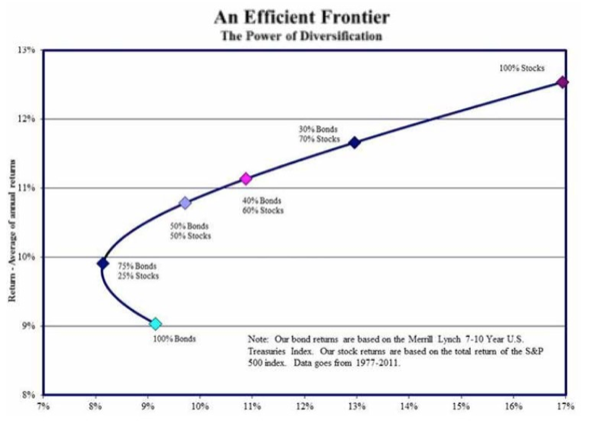

Based on the selected risk level, the expected return is determined. This can be seen, for example, in the following classic graph that relates profitability to risk in the so-called «efficient frontier»:

Graph 7. Efficient frontier in the US market

A simple distribution of a financial portfolio of bonds and stocks shows the relationship between the risk that a person is willing to take and the expected return that can be achieved. Beyond the specificities in the person’s risk profile (which changes over time), this scheme offers an adequate framework for decision-making, but most importantly determines the key to any investment that is the «true» profile of risk; that is, what capacity of resistance an investor has in the face of heavy or moderate losses, and for how long. To determine this, the person undergoes a stress exercise of viewing scenarios where his investment suffers increasing losses or even total loss. The question is: “Are you reassured enough knowing that during your life cycle some of the resources you have could suffer a maximum potential loss of XX%?” This is where the person will realise his actual aversion to risk versus perceived risk. It is much more important (and therefore the focus is on this aspect) to determine how much a person can «endure» in a loss scenario that determine the optimal investment portfolio.

Conclusions

This series of reports on the financial health of families has purported to offer realistic recipes to aid the reader on his or her particular «journey» toward financial independence. It’s about putting money to work for the person, not the other way around. We hope that our efforts will provide citizens with practical tools to live better, help them be more aware of their decisions, and encourage them to work for a society of freer and more prosperous people.